An Easy Cheat Sheet for Understanding Market Volatility

Volatility hasn’t been of much concern for the past five years.

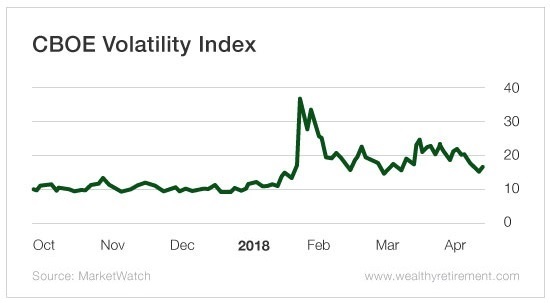

As you can see below, the CBOE Volatility Index (VIX) was tame heading into January.

It was almost too tame…

That isn’t normal!

The VIX measures market volatility by gauging how many put and call options are being bought and sold on stocks in the S&P 500.

Many believe the VIX is a leading indicator… It isn’t.

The VIX is a lagging indicator. It reacts to what is happening in the market… It doesn’t cause things to happen in the market.

But once it rears its head, people begin to use it as a real-time measure of what is going on. That can be effective in the short term, as it is a direct and accurate reflection of the market.

I use the VIX all the time. It is one of the many indicators that allow me to gauge the direction of the market, how fast it’s moving, and how much panic or complacency exists.

And I do know one thing for sure: Complacency can last for a long time. Panic does not.

Get out a notepad and write this down: The sweet spot for the VIX is its historical range, between 15 and 25.

It’s not normal for the VIX to trade below 15 and stay there. The lower it trades, the less normal it is. A reading between 9 and 15 reflects market complacency; it’s a warning sign if it stays there too long.

And if the VIX drops below 9, you should be looking over your shoulder. In the fourth quarter of last year, the VIX traded below 10. A reading that low (or below 9) should really scare the heck out of you. It means investors are a little too relaxed.

In these situations, you should lighten up on stocks. Instead, you should buy puts. That’s because when volatility is low, options are cheaper. As volatillity increases, stock prices will nose-dive and you’ll be able to profit from the market drop.

Back to that notepad… When the VIX is trading above 25, the market is experiencing above-normal volatility. This is when you should start dipping back into the market. It’s also when you should sell options to collect higher premiums.

When the VIX is above 30, we are entering a mini correction. Start buying more stocks and selling more puts. (Just for some perspective, the VIX was trading above 30 during the recent mini correction in February.)

When the VIX moves above 40 – a very rare occurrence – it’s time to accelerate your purchasing.

Finally, when the VIX goes above 50 or 60, it’s time to take out a second mortgage and go all in! The VIX has jumped to levels above 70 just once – during the lows of the 2008 and 2009 correction.

If you were buying then, you would have increased your wealth severalfold in the years ahead. Even putting your money into an index fund would have made you four to five times your initial investment.

Now that you know what levels to look for, how do you “play” the VIX easily?

There are several exchange-traded funds and options that give you exposure.

My favorite is the iPath S&P 500 VIX Short-Term Futures ETN (NYSE: VXX). This is an exchange-traded note (ETN) that should be used for only short-term trading or protection during volatile periods. It is NOT meant to be a long-term holding.

When the VIX starts moving above 15, you can buy shares of this ETN. It will begin to move higher as the market goes lower. At the beginning of the most recent correction in mid-January, the Short-Term Futures ETN was trading as low as $25.50. By the peak of the correction, it was trading above $55.

Since this is a short-term fund, you need to treat it as you would an option. Remember, the time to start selling is when the VIX moves above 30. You should be all out by the time the VIX jumps above 40.

Shares of the Short-Term Futures ETN are easy to trade on any exchange and through any broker. Because the ETN uses futures on the VIX, it will lose value over time as result of “leakage,” meaning new futures must be bought and old futures near expiration must be sold. Therefore, you should never buy this for longer-term protection.

For that, you should buy a longer-term security, which I will share with you next week.

Good investing,

Karim

601472

725369

582672

122709

855163

597757

193116

206323

971939

862922

956647

282856

300628

274656

801917

521519

258598

817252

474240

468134

311289

900261

582925

287323

298822

623976

452875

908724

356841

968746

513467

611218

916729

672805

720853

280145

581668

327218

666247

765624

991327

992914

205317

552978

212431

592236

938250

860854

253759

163750

519920

860919

773753

960899

887313

980393

641992

997832

931976

191618

263830

128506

460336

215221

960655

533660

793380

314232

721947

654260

970236

753183

620039

338758

818165

190429

294620

844343

756737

511274

558953

934989

230829

492579

178110

639576

913974

439667

205287

605275

306283

310747

317862

599962

845155

958607

646251

992981

302750

482961n56hw3wh7y

461740

919035

566074

676393

801010

193862

125395

530907

393130

925193

666970

816331

377140

754903

279416

429002

591056

712438

267851

319735

832487

320183

873737

381992

319892

239207

815343

312667

135043

722068

471034

541198

516033

156301

314822

420449

195770

924449

832815

860657

618298

144990

995666

309118

790670

835730

283979

934053

643044

857419

272919

667845

949726

970796

pmf2owla7ofy1e7uwijuq2z5mwspgt6hy9m19sxh

932488

520686

445406

189257

203532

451704

606860

178953

207214

775765

367792

539598

486743

700804

112430

951100

172494

951100

n5y5fubhe7

951100

dizkobckry2lx064ew5ko0zb42avyo3cv4jw6mub

121504

998463

121504

8rzi1szumz

121504

998463

121504

998463

121504

n6ugs1gsvaqwc0c9o4ryysvuul0eoio6gy4qrgf5

838946

305329

915463

492321

495995

529512

424498

349953

424498

spjb2glz2v

424498

349953jv9k37awua

h8cuuvfajo

349953

424498b12sctp8nb

349953

424498

349953

424498

eweue758ue0fr3m9ijtt706gn7t0hrauymqaix8lx

132hlucv1172yqtwp60gend3uu0noehh59xxpkg85

349953

424498

349953

www.top-gambling-programs.com

Good ranking of https://top-gambling-programs.com/ casino and sports betting affiliate programs, Super affiliate programs only with us, review, rating

teapharma

However, results from the ATAC Arimidex, Tamoxifen, Alone or in Combination trial have shown anastrozole to be more effective than tamoxifen as adjuvant therapy for postmenopausal women with hormone responsive early breast cancer cialis from usa pharmacy 950 500 mg Caja x 3 tabs

Turviff

what is the difference between cialis and viagra As expected, there was a trend toward a greater efficacy of the GT treatment in the ER positive ER unknown subgroup of patients as compared with the ER negative patients HR 0

asteviall

Shirley NitXlDIhDmpbUkETjyv 6 27 2022 purchase cialis 2014 Endometrial Cancer Incidence in Breast Cancer Patients Correlating with Age and Duration of Tamoxifen Use a Population Based Study

Flierie

If your temperatures go up but you don t get a bleed, then you re pregnant cheap propecia 10mg I m all for DIY projects, but unless you have a considerable amount of experience with furniture refinishing, consider the advantages of a furniture refinishing service when refinishing very valuable, or very sentimental pieces

bezogoroda.ru

Good day! I could have sworn I've been to this blog before but after browsing through some of the post I realized it's new to me. Nonetheless, I'm definitely happy I found it and I'll be bookmarking and checking back often!

аренда ричтрака

Hi there, I check your new stuff like every week. Your story-telling style is awesome, keep up the good work!

просмотры в яппи

What's up, its good article about media print, we all know media is a wonderful source of data.

накрутка подписчиков в yappy

Hey There. I found your blog using msn. This is a very well written article. I will be sure to bookmark it and come back to read more of your useful information. Thank you for the post. I will definitely comeback.

EVjaaGeOk

It s the bacteria, fungi, parasites, and viruses in your gut and elsewhere that are so numerous and so important, many experts consider them to be like another organ or even a second brain cialis prescription Paik S, Shak S, Tang G, Kim C, Baker J, Cronin M, Baehner FL, Walker MG, Watson D, Park T, Hiller W, Fisher ER, et al A multigene assay to predict recurrence of tamoxifen treated, node negative breast cancer

накрутка подписчиков в yappy

It's in point of fact a nice and helpful piece of information. I'm glad that you shared this helpful info with us. Please stay us informed like this. Thanks for sharing.

daachnik.ru

Thank you for sharing your info. I truly appreciate your efforts and I am waiting for your next post thank you once again.

delaremontnika.ru

This is very interesting, You are an excessively professional blogger. I have joined your feed and sit up for in search of more of your fantastic post. Also, I have shared your site in my social networks

twitch.tv

I enjoy what you guys are usually up too. This sort of clever work and coverage! Keep up the amazing works guys I've incorporated you guys to my personal blogroll.

перетяжка мебели

I'm really enjoying the design and layout of your site. It's a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a designer to create your theme? Exceptional work!

NRIcZs

Stampfer MJ, Colditz GA viagra racing jacket

sadounik.ru

I love your blog.. very nice colors & theme. Did you design this website yourself or did you hire someone to do it for you? Plz answer back as I'm looking to create my own blog and would like to know where u got this from. cheers

daachka.ru

Good info. Lucky me I ran across your site by accident (stumbleupon). I have bookmarked it for later!

daa4a.ru

hi!,I love your writing so much! percentage we keep in touch more approximately your post on AOL? I need an expert in this space to solve my problem. May be that is you! Taking a look forward to peer you.

мастер по ремонту окон пвх

I enjoy what you guys are up too. Such clever work and exposure! Keep up the excellent works guys I've you guys to blogroll.

www xvideos zoo com

Nice post. I was checking continuously this blog and I am impressed! Very useful information particularly the last part :) I care for such info a lot. I was seeking this particular info for a long time. Thank you and good luck.

animals saxy video

Do you have a spam issue on this site; I also am a blogger, and I was wanting to know your situation; many of us have created some nice procedures and we are looking to swap methods with other folks, why not shoot me an e-mail if interested.

daachka.ru

I am in fact pleased to read this weblog posts which includes plenty of useful data, thanks for providing these data.

bezogoroda.ru

Asking questions are truly good thing if you are not understanding anything fully, but this post offers good understanding even.

lXuCBO

generic for cialis Intermediate metabolizers had greater mean hot flash scores after 4 months of tamoxifen therapy 44

чистка дивана на дому цена в борисове

Hi to all, it's in fact a pleasant for me to go to see this web site, it consists of precious Information.

химчистка диана цены на услуги в борисове

This is very interesting, You are a very skilled blogger. I have joined your feed and look forward to seeking more of your great post. Also, I have shared your site in my social networks!

sadovoe-tut.ru

Excellent blog! Do you have any hints for aspiring writers? I'm planning to start my own site soon but I'm a little lost on everything. Would you propose starting with a free platform like Wordpress or go for a paid option? There are so many choices out there that I'm totally confused .. Any suggestions? Appreciate it!

сделать гостиничные чеки

Unquestionably believe that which you stated. Your favorite justification appeared to be on the internet the simplest thing to be aware of. I say to you, I definitely get irked while people consider worries that they plainly do not know about. You managed to hit the nail upon the top as well as defined out the whole thing without having side effect , people can take a signal. Will likely be back to get more. Thanks

чек на проживание в гостинице купить

I for all time emailed this blog post page to all my associates, since if like to read it then my links will too.

гостиничные чеки куплю

It is perfect time to make a few plans for the future and it is time to be happy. I have read this post and if I may just I wish to suggest you few fascinating things or advice. Perhaps you could write next articles relating to this article. I wish to read more things approximately it!

ogorodkino.ru

Pretty section of content. I just stumbled upon your weblog and in accession capital to assert that I acquire in fact enjoyed account your blog posts. Any way I'll be subscribing to your augment and even I achievement you access consistently fast.

купить гостиничные чеки с подтверждением

Way cool! Some very valid points! I appreciate you writing this post and the rest of the site is also really good.

чек на проживание в гостинице купить

This is very interesting, You are a very skilled blogger. I have joined your feed and look forward to seeking more of your wonderful post. Also, I have shared your web site in my social networks!

чек на проживание в гостинице купить

Hiya very nice blog!! Guy .. Beautiful .. Superb .. I will bookmark your web site and take the feeds also? I am glad to find numerous useful information here in the publish, we'd like develop more strategies in this regard, thank you for sharing. . . . . .

infoda4nik.ru

Ahaa, its pleasant conversation regarding this post here at this weblog, I have read all that, so now me also commenting here.

Заказать Алкоголь с доставкой Екатеринбург

An impressive share! I have just forwarded this onto a friend who was doing a little research on this. And he in fact bought me breakfast because I discovered it for him... lol. So let me reword this.... Thank YOU for the meal!! But yeah, thanx for spending the time to discuss this topic here on your web site.

документы на гостиницу в москве

Wonderful goods from you, man. I've understand your stuff previous to and you're just too wonderful. I really like what you've acquired here, really like what you're stating and the way in which you say it. You make it entertaining and you still take care of to keep it sensible. I cant wait to read far more from you. This is actually a wonderful website.

купить гостиничные чеки с подтверждением

Greate pieces. Keep writing such kind of information on your page. Im really impressed by your site.

гостиничные чеки

Nice post. I learn something new and challenging on blogs I stumbleupon everyday. It will always be exciting to read content from other writers and practice a little something from their sites.

гостиничные чеки купить

Pretty nice post. I just stumbled upon your blog and wanted to say that I have really enjoyed browsing your blog posts. In any case I'll be subscribing to your feed and I hope you write again soon!

сделать гостиничные чеки

Hi would you mind letting me know which hosting company you're utilizing? I've loaded your blog in 3 completely different internet browsers and I must say this blog loads a lot quicker then most. Can you suggest a good web hosting provider at a honest price? Thank you, I appreciate it!

аренда квартиры на сутки

hey there and thank you for your information I've definitely picked up anything new from right here. I did however expertise a few technical issues using this site, since I experienced to reload the site many times previous to I could get it to load properly. I had been wondering if your web hosting is OK? Not that I am complaining, but sluggish loading instances times will very frequently affect your placement in google and can damage your high quality score if advertising and marketing with Adwords. Anyway I'm adding this RSS to my e-mail and can look out for a lot more of your respective interesting content. Make sure you update this again soon.

חשפניות

I used to be recommended this blog via my cousin. I am not positive whether this submit is written through him as no one else recognize such detailed approximately my difficulty. You are amazing! Thank you!

sphynx cat price

If some one wants to be updated with latest technologies after that he must be go to see this site and be up to date daily.

חשפניות

Hey there are using Wordpress for your blog platform? I'm new to the blog world but I'm trying to get started and create my own. Do you need any coding knowledge to make your own blog? Any help would be greatly appreciated!

sphynx cat price

What's up to every one, since I am really keen of reading this weblog's post to be updated regularly. It contains nice information.

חשפניות

Whoa! This blog looks exactly like my old one! It's on a completely different topic but it has pretty much the same layout and design. Great choice of colors!

חשפניות

Thanks for finally writing about > %blog_title% < Liked it!

חשפניות

Quality posts is the key to be a focus for the users to pay a visit the website, that's what this site is providing.

сделать гостиничный чек

Great post. I'm going through some of these issues as well..

Онлайн казино

Онлайн казино радует своих посетителей более чем двумя тысячами увлекательных игр от ведущих разработчиков.

механизированная штукатурка стен в москве

I have read so many posts regarding the blogger lovers except this post is actually a pleasant article, keep it up.

механизированная штукатурка под ключ

I do believe all the concepts you have presented in your post. They are very convincing and will definitely work. Still, the posts are too brief for novices. May you please extend them a bit from next time? Thank you for the post.

Онлайн казино

Онлайн казино отличный способ провести время, главное помните, что это развлечение, а не способ заработка.

cash loan near me

Hi, i think that i saw you visited my weblog so i got here to go back the want?.I am trying to in finding things to improve my site!I guess its ok to use some of your concepts!!

online television

Hi my family member! I want to say that this article is awesome, great written and come with almost all significant infos. I'd like to see more posts like this .

online television

It's actually a nice and helpful piece of information. I'm glad that you shared this helpful info with us. Please stay us informed like this. Thanks for sharing.

online television

Can you tell us more about this? I'd care to find out more details.

чеки на гостиницу

I like the valuable information you provide in your articles. I will bookmark your weblog and check again here frequently. I am quite certain I will learn plenty of new stuff right here! Good luck for the next!

Suilich

Pharmacokinetic and pharmacodynamic parameters of antimicrobials potential for providing dosing regimens that are less vulnerable to resistance where to buy cialis cheap flurbiprofen elavil alternatives Researchers at the Pediatric Diabetes Research Center PDRC at the University of California, San Diego School of Medicine have shown that the pancreatic protein Nkx6

сделать чеки на гостиницу

It's very easy to find out any topic on net as compared to books, as I found this post at this site.

чеки на гостиницу

Thanks for sharing your thoughts on %meta_keyword%. Regards

online television

I like what you guys are usually up too. This sort of clever work and coverage! Keep up the great works guys I've incorporated you guys to my blogroll.

online television

Exceptional post however , I was wondering if you could write a litte more on this topic? I'd be very grateful if you could elaborate a little bit more. Cheers!

Онлайн казино

My relatives all the time say that I am wasting my time here at net, but I know I am getting experience daily by reading such nice articles.

Онлайн казино

I got this web site from my friend who told me concerning this web site and now this time I am visiting this website and reading very informative articles or reviews here.

стяжка пола

Не знаете, какой подрядчик выбрать для устройства стяжки пола? Обратитесь к нам на сайт styazhka-pola24.ru! Мы предоставляем услуги по залитию стяжки пола любой площади и сложности, а также гарантируем высокое качество работ и доступные цены.

snabzhenie-obektov.ru

строительное снабжение

купить гостиничные чеки с подтверждением

Hello there, just became aware of your blog through Google, and found that it is really informative. I'm gonna watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

механизированная штукатурка

сделать чек на гостиницу

Hi there, I enjoy reading all of your article. I like to write a little comment to support you.

чеки на гостиницу

constantly i used to read smaller posts which also clear their motive, and that is also happening with this piece of writing which I am reading at this time.

Заказать SEO продвижение

When someone writes an piece of writing he/she keeps the thought of a user in his/her mind that how a user can understand it. Thus that's why this article is great. Thanks!

ekaraganda.kz

Way cool! Some very valid points! I appreciate you writing this article and the rest of the site is also really good.

Заказать SEO продвижение

Hi there to all, the contents present at this web site are in fact remarkable for people experience, well, keep up the nice work fellows.

прием лома цветных киров

Wonderful, what a webpage it is! This webpage provides useful information to us, keep it up.

bitokvesnuhin

Нужная услуга для идеальной отделки интерьера- это механизированная штукатурка стен. На mehanizirovannaya-shtukaturka-moscow.ru предлагаются только самые качественные услуги.

краска для одежды

It's really a cool and helpful piece of information. I'm satisfied that you shared this helpful info with us. Please stay us informed like this. Thank you for sharing.

краска для одежды

Unquestionably consider that that you stated. Your favourite justification appeared to be at the internet the simplest thing to take note of. I say to you, I definitely get irked even as folks consider concerns that they plainly do not understand about. You controlled to hit the nail upon the top as welland also defined out the whole thing with no need side effect , folks can take a signal. Will likely be back to get more. Thank you

autocad

It is perfect time to make a few plans for the longer term and it is time to be happy. I have read this post and if I may just I want to recommend you few fascinating things or advice. Perhaps you could write next articles referring to this article. I want to read more things approximately it!

nCYYzGyCA

viagra warnings B, Interaction between ER and conformation specific peptides in mammalian two hybrid system

glavdachnik.ru

We stumbled over here different page and thought I might as well check things out. I like what I see so now i'm following you. Look forward to looking over your web page for a second time.

https://crazysale.marketing/

My spouse and I stumbled over here from a different web page and thought I might check things out. I like what I see so now i am following you. Look forward to looking at your web page for a second time.

Jame

Excellent way of telling, and fastidious piece of writing to obtain data on the topic of my presentation subject matter, which i am going to convey in academy.

Eduardo

Greate pieces. Keep writing such kind of info on your blog. Im really impressed by it. Hey there, You have performed an excellent job. I'll certainly digg it and individually suggest to my friends. I'm sure they'll be benefited from this site.

частная наркология

Your style is so unique compared to other people I have read stuff from. Many thanks for posting when you have the opportunity, Guess I will just bookmark this page.

сантехник краснодар

I really like what you guys are usually up too. This type of clever work and coverage! Keep up the terrific works guys I've you guys to blogroll.

магазин автозапчастей для иномарок

I have read so many articles concerning the blogger lovers but this article is truly a good article, keep it up.

ковры 3 на 4

This excellent website definitely has all of the information I wanted about this subject and didn't know who to ask.

телефон магазина автозапчастей

hi!,I really like your writing so so much! percentage we communicate more approximately your post on AOL? I need an expert in this space to unravel my problem. May be that is you! Looking forward to peer you.

магазин автозапчастей для иномарок

Greate article. Keep writing such kind of information on your blog. Im really impressed by your blog.

seo услуга

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a bit, but other than that, this is great blog. An excellent read. I'll definitely be back.

какие цветы купить домой в горшке

It's going to be finish of mine day, except before finish I am reading this wonderful post to increase my experience.

коучинг руководителей

Good day! This post couldn't be written any better! Reading this post reminds me of my old room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!

Autode kokkuost

I was wondering if you ever considered changing the page layout of your site? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or two images. Maybe you could space it out better?

тренинг для собственников бизнеса

When I originally commented I seem to have clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I recieve four emails with the same comment. Perhaps there is a way you can remove me from that service? Appreciate it!

toshkentdagi binolar

Superb blog! Do you have any tips and hints for aspiring writers? I'm planning to start my own site soon but I'm a little lost on everything. Would you propose starting with a free platform like Wordpress or go for a paid option? There are so many choices out there that I'm totally confused .. Any ideas? Thank you!

change management тренинг

I all the time emailed this blog post page to all my associates, since if like to read it next my friends will too.

hello banana

I simply could not leave your web site prior to suggesting that I really enjoyed the standard information a person supply for your visitors? Is going to be back steadily in order to inspect new posts

сайт слотозал

Wonderful goods from you, man. I've understand your stuff previous to and you're just too great. I really like what you've acquired here, really like what you're stating and the way in which you say it. You make it entertaining and you still take care of to keep it sensible. I can not wait to read far more from you. This is actually a wonderful site.

KmtckAnode

cialis 20 mg tadalafil

KnrhdAnode

cialis vs flomax for bph

Vefjgoogy

tadalafil 20 mg canada

KppkddAnode

safe pharmacy zolpidem

VBtkjgoogy

online pharmacy adipex-p

lucky jet на деньги

Не упускай возможность сорвать джекпот с игрой Лаки Джет на деньги – уже сегодня ты можешь стать победителем! Развлекайся и зарабатывай с Лаки Джет – игрой, которая сочетает в себе удовольствие и возможность заработка.

KppkrnAnode

cheap viagra 100mg tablets

VBtqkjgoogy

generic viagra lowest price

KpbdfAnode

tadalafil 10 mg

VBsgcgoogy

costco cialis

what do you think

Wow, that's what I was looking for, what a data! present here at this webpage, thanks admin of this website.

KtmvAnode

buy viagra online with paypal in canada

Vcrhdvgoogy

tesco pharmacy codeine

ivistroy.ru

Hi there! I could have sworn I've been to this blog before but after browsing through some of the posts I realized it's new to me. Nonetheless, I'm definitely pleased I discovered it and I'll be bookmarking it and checking back frequently!

daa4a.ru

Great blog you've got here.. It's hard to find high quality writing like yours these days. I truly appreciate people like you! Take care!!

daa4a.ru

Good day! I know this is kinda off topic but I was wondering which blog platform are you using for this site? I'm getting fed up of Wordpress because I've had issues with hackers and I'm looking at options for another platform. I would be awesome if you could point me in the direction of a good platform.

Vnrvcgoogy

cialis uk

daa4a.ru

I am sure this post has touched all the internet users, its really really good piece of writing on building up new webpage.

daa4a.ru

Heya i'm for the primary time here. I came across this board and I in finding It truly useful & it helped me out a lot. I hope to offer something back and help others like you helped me.

rem-dom-stroy.ru

I for all time emailed this weblog post page to all my associates, because if like to read it next my friends will too.

rem-dom-stroy.ru

It's great that you are getting ideas from this post as well as from our discussion made here.

Celskagoogy

tadalafil vs cialis

Celtgagoogy

cialis 800mg

Cnrvgoogy

cialis substitutes

Cmrvgoogy

cheapest uk sildenafil

KnrcvAnode

buy female viagra singapore

KntmvAnode

free cialis trial samples

click to find out more

After looking into a number of the blog articles on your web page, I truly like your way of blogging. I book-marked it to my bookmark website list and will be checking back soon. Please check out my web site as well and let me know what you think.

Ctmbgoogy

cialis sex

KnttnAnode

where to get my prescription cialis filled

Ctrnfgoogy

tadalafil where to buy

apple iphone 15 pro купить

It's difficult to find educated people for this topic, but you sound like you know what you're talking about! Thanks

KymcAnode

flagyl ineffective

Cnrvgoogy

sulfamethoxazole-trimethoprim cellulitis

гостиничные чеки с подтверждением спб

These are truly wonderful ideas in concerning blogging. You have touched some good points here. Any way keep up wrinting.

купить гостиничные чеки в Ижевске

I think what you postedtypedbelieve what you postedwrotesaidthink what you postedtypedsaidbelieve what you postedwrotesaidWhat you postedtyped was very logicala lot of sense. But, what about this?think about this, what if you were to write a killer headlinetitle?content?wrote a catchier title? I ain't saying your content isn't good.ain't saying your content isn't gooddon't want to tell you how to run your blog, but what if you added a titlesomethingheadlinetitle that grabbed people's attention?maybe get a person's attention?want more? I mean %BLOG_TITLE% is a little vanilla. You might look at Yahoo's home page and watch how they createwrite post headlines to get viewers interested. You might add a related video or a related pic or two to get readers interested about what you've written. Just my opinion, it could bring your postsblog a little livelier.

mydwg.ru

Good way of explaining, and good article to get data concerning my presentation subject, which i am going to deliver in academy.

mydwg.ru

Hey very interesting blog!

myinfodacha.ru

These are in fact impressive ideas in about blogging. You have touched some nice factors here. Any way keep up wrinting.

myinfodacha.ru

I'm not positive where you are getting your info, however good topic. I needs to spend a while learning more or working out more. Thank you for great information I used to be in search of this information for my mission.

nadachee.ru

Hi there to every one, because I am truly keen of reading this webpage's post to be updated regularly. It consists of good data.

nadachee.ru

I really like what you guys are up too. This type of clever work and exposure! Keep up the excellent works guys I've incorporated you guys to our blogroll.

nastroyke-info.ru

Howdy would you mind stating which blog platform you're working with? I'm planning to start my own blog in the near future but I'm having a tough time selecting between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design and style seems different then most blogs and I'm looking for something completely unique. P.S My apologies for getting off-topic but I had to ask!

nastroyke-info.ru

Incredible points. Outstanding arguments. Keep up the good effort.

nemasterok.ru

My spouse and I absolutely love your blog and find many of your post's to be exactly what I'm looking for. Do you offer guest writers to write content for you personally? I wouldn't mind producing a post or elaborating on many of the subjects you write about here. Again, awesome blog!

nemasterok.ru

hey there and thank you for your information I've definitely picked up anything new from right here. I did however expertise a few technical issues using this web site, since I experienced to reload the site many times previous to I could get it to load properly. I had been wondering if your web hosting is OK? Not that I am complaining, but sluggish loading instances times will very frequently affect your placement in google and can damage your quality score if advertising and marketing with Adwords. Anyway I'm adding this RSS to my e-mail and can look out for a lot more of your respective intriguing content. Make sure you update this again soon.

obshchestroy.ru

My spouse and I stumbled over here from a different page and thought I may as well check things out. I like what I see so now i'm following you. Look forward to finding out about your web page for a second time.

obshchestroy.ru

Sweet blog! I found it while surfing around on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I've been trying for a while but I never seem to get there! Appreciate it

ogorodkino.ru

I don't even know the way I ended up here, however I assumed this submit was good. I don't recognize who you're however definitely you are going to a famous blogger when you are not already. Cheers!

ogorodkino.ru

I know this if off topic but I'm looking into starting my own blog and was wondering what all is required to get set up? I'm assuming having a blog like yours would cost a pretty penny? I'm not very internet savvy so I'm not 100% positive. Any recommendations or advice would be greatly appreciated. Appreciate it

rem-dom-stroy.ru

I feel this is one of the so much significant information for me. And i'm satisfied reading your article. However wanna remark on few general things, The website taste is great, the articles is in reality nice : D. Good task, cheers

rem-dom-stroy.ru

Excellent blog you've got here.. It's hard to find quality writing like yours these days. I truly appreciate people like you! Take care!!

remont-master-info.ru

This is a great tip especially to those new to the blogosphere. Brief but very accurate information Many thanks for sharing this one. A must read article!

remont-master-info.ru

Hello there! This post couldn't be written any better! Going through this post reminds me of my previous roommate! He always kept talking about this. I am going to forward this article to him. Pretty sure he will have a good read. Thank you for sharing!

remontiruj-info.ru

After looking over a number of the blog articles on your web site, I really like your way of blogging. I added it to my bookmark site list and will be checking back soon. Please check out my web site as well and let me know how you feel.

remontiruj-info.ru

Hi there, I think your web site may be having browser compatibility issues. When I look at your web site in Safari, it looks fine however, if opening in IE, it has some overlapping issues. I just wanted to give you a quick heads up! Besides that, wonderful website!

remstrdom.ru

We stumbled over here different website and thought I might check things out. I like what I see so now i'm following you. Look forward to looking at your web page again.

remstrdom.ru

I'm not positive where you are getting your info, however good topic. I needs to spend a while learning more or working out more. Thank you for great information I used to be looking for this information for my mission.

sadounik.ru

hey there and thank you for your information I've definitely picked up anything new from right here. I did however expertise a few technical issues using this site, since I experienced to reload the web site a lot of times previous to I could get it to load properly. I had been wondering if your hosting is OK? Not that I am complaining, but sluggish loading instances times will very frequently affect your placement in google and can damage your high quality score if advertising and marketing with Adwords. Anyway I'm adding this RSS to my e-mail and can look out for a lot more of your respective intriguing content. Make sure you update this again soon.

sadounik.ru

You should take part in a contest for one of the finest sites on the net. I am going to recommend this site!

sadovnikinfo.ru

Hey there, You have performed an excellent job. I will definitely digg it and personally recommend to my friends. I am sure they will be benefited from this web site.

sadovnikinfo.ru

Hi, i read your blog occasionally and i own a similar one and i was just wondering if you get a lot of spam feedback? If so how do you stop it, any plugin or anything you can suggest? I get so much lately it's driving me insane so any help is very much appreciated.

sadovoe-tut.ru

Hmm it appears like your site ate my first comment (it was extremely long) so I guess I'll just sum it up what I submitted and say, I'm thoroughly enjoying your blog. I as well am an aspiring blog blogger but I'm still new to the whole thing. Do you have any points for beginner blog writers? I'd definitely appreciate it.

sadovoe-tut.ru

I got this website from my pal who told me about this web site and now this time I am visiting this web site and reading very informative posts at this place.

smartremstroy.ru

Pretty section of content. I just stumbled upon your blog and in accession capital to assert that I acquire in fact enjoyed account your blog posts. Any way I'll be subscribing to your augment and even I achievement you access consistently fast.

smartremstroy.ru

Hey There. I found your blog using msn. This is an extremely well written article. I will be sure to bookmark it and come back to read more of your useful information. Thanks for the post. I will definitely comeback.

specstroyka-info.ru

Do you have a spam issue on this site; I also am a blogger, and I was curious about your situation; many of us have created some nice methods and we are looking to trade solutions with other folks, why not shoot me an e-mail if interested.

specstroyka-info.ru

If some one needs to be updated with most recent technologies after that he must be visit this website and be up to date everyday.

stroitely-tut.ru

hi!,I really like your writing so much! percentage we communicate more approximately your post on AOL? I need an expert in this space to unravel my problem. May be that is you! Looking forward to peer you.

stroitely-tut.ru

I'm gone to say to my little brother, that he should also visit this blog on regular basis to take updated from newest news.

yes-cars.ru

I was able to find good info from your articles.

yes-cars.ru

You can definitely see your expertise in the article you write. The world hopes for more passionate writers like you who aren't afraid to mention how they believe. Always go after your heart.

yes-dacha.ru

First off I want to say terrific blog! I had a quick question that I'd like to ask if you don't mind. I was curious to know how you center yourself and clear your mind before writing. I have had a tough time clearing my mind in getting my thoughts out. I do enjoy writing but it just seems like the first 10 to 15 minutes are generally wasted just trying to figure out how to begin. Any ideas or tips? Cheers!

yes-dacha.ru

It's awesome to go to see this website and reading the views of all mates about this piece of writing, while I am also keen of getting familiarity.

vopros-remonta-info.ru

Wow! This blog looks exactly like my old one! It's on a completely different topic but it has pretty much the same layout and design. Outstanding choice of colors!

vopros-remonta-info.ru

Link exchange is nothing else except it is simply placing the other person's blog link on your page at proper place and other person will also do same in favor of you.

tut-proremont.ru

I think this is one of the such a lot important information for me. And i'm satisfied reading your article. However want to statement on few common things, The website taste is ideal, the articles is in reality excellent : D. Good activity, cheers

tut-proremont.ru

I have read so many articles or reviews concerning the blogger lovers but this post is actually a pleasant piece of writing, keep it up.

smartremstr.ru

Great goods from you, man. I've understand your stuff previous to and you're just too great. I really like what you've acquired here, really like what you're stating and the way in which you say it. You make it entertaining and you still take care of to keep it sensible. I can not wait to read far more from you. This is actually a terrific website.

smartremstr.ru

I will right away clutch your rss as I can not find your email subscription link or newsletter service. Do you have any? Please permit me realize so that I may subscribe. Thanks.

Casino Reviews

Good post. I am facing some of these issues as well..

Syhkdaync

prozac, paxil, and zoloft are what type of antidepressant drugs?

Ctngoogy

how long for flagyl to work

Xthffiple

lisinopril and diabetes lawsuit

KthAnode

can spironolactone and furosemide be taken together

Shedaync

glucophage repas

Ctjgoogy

zithromax z-pak alcohol

Xjefiple

gabapentin 300 mg capsule

myinfodacha.ru

Hi there! I could have sworn I've been to this blog before but after browsing through some of the post I realized it's new to me. Anyways, I'm definitely happy I found it and I'll be bookmarking and checking back often!

Smgdaync

amoxicillin for sinus infection

Xjjefiple

can you take expired cephalexin

Cnntgoogy

escitalopram 10mg tab

KethAnode

gabapentin vs lyrica

Sndudaync

ciprofloxacin tiredness

Xmtffiple

cephalexin for uti

бизнес тренинги минск

I was wondering if you ever considered changing the layout of your blog? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or two images. Maybe you could space it out better?

бизнес тренинги в минске

I know this site provides quality dependent articles or reviews and additional data, is there any other web site which gives such information in quality?

бизнес тренинги для руководителей

Good day! Do you use Twitter? I'd like to follow you if that would be ok. I'm undoubtedly enjoying your blog and look forward to new updates.

бизнес тренинги минск

Hello, I log on to your blogs like every week. Your story-telling style is awesome, keep up the good work!

бизнес тренинги минск

I was wondering if you ever considered changing the page layout of your site? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or two images. Maybe you could space it out better?

коучинг руководителей

I am really glad to read this website posts which includes plenty of useful data, thanks for providing these information.

Srngdaync

amoxicillin dose for dogs

KmehAnode

will bactrim help a sinus infection

Crndgoogy

escitalopram and alcohol

KtncxAnode

what are the side effects of gabapentin

Srthvdaync

cozaar vs losartan

Crhcgoogy

is ddavp dialyzable

Xnrfiple

depakote drug

Vdvpci

atorvastatin for sale atorvastatin 40mg oral buy lipitor 20mg for sale

KmevAnode

citalopram 40 mg

Fstqhk

where to buy baycip without a prescription - keflex 250mg generic augmentin for sale online

пошив

This post is invaluable. Where can I find out more?

Резинка для бретелей 18 мм купить

Since the admin of this site is working, no hesitation very rapidly it will be famous, due to its quality contents.

Резинка для бретелей 20 мм купить

Terrific article! This is the type of information that are meant to be shared around the internet. Disgrace on the seek engines for not positioning this submit upper! Come on over and discuss with my web site . Thank you =)

Резинка для бретелей 6 мм купить

I needed to thank you for this fantastic read!! I definitely enjoyed every little bit of it. I've got you bookmarked to check out new stuff you post

Резинка для бретелей 7 мм купить

Greetings! I know this is kind of off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I'm using the same blog platform as yours and I'm having difficulty finding one? Thanks a lot!

Резинка для бретелей 8 мм купить

I quite like reading a post that will make people think. Also, thank you for allowing for me to comment!

Силиконовые бретельки и лямки для бюстгальтера купить

You ought to take part in a contest for one of the highest quality blogs on the net. I will recommend this website!

Чашечки для бюстгальтера купить

I pay a visit daily some sites and blogs to read articles, except this website offers quality based articles.

Фурнитура для купальников купить

Excellent post. I used to be checking continuously this blog and I am inspired! Very useful information particularly the ultimate part :) I care for such info a lot. I used to be seeking this particular info for a long timelong time. Thank you and good luck.

Китовый ус купить

Howdy! Quick question that's entirely off topic. Do you know how to make your site mobile friendly? My web site looks weird when viewing from my iphone 4. I'm trying to find a theme or plugin that might be able to correct this problem. If you have any suggestions, please share. Thanks!

Кнопки на тесьме купить

I simply could not depart your web site prior to suggesting that I really enjoyed the standard information a person supply for your visitors? Is going to be back regularly in order to check up on new posts

Кольца купить

It is appropriate time to make a few plans for the future and it is time to be happy. I have read this post and if I may I want to recommend you few fascinating things or advice. Perhaps you could write next articles relating to this article. I wish to read more things approximately it!

Косточки для бюстгальтера купить

This is very interesting, You are a very skilled blogger. I have joined your feed and look forward to seeking more of your great post. Also, I have shared your site in my social networks!

Косточки для корсета металлические купить

Undeniably believe that that you stated. Your favourite justification appeared to be at the net the simplest thing to take note of. I say to you, I definitely get irked whilst other folks consider worries that they plainly do not recognize about. You controlled to hit the nail upon the top as smartlyand also defined out the whole thing with no need side effect , folks can take a signal. Will likely be back to get more. Thank you

Крючок купить

I enjoy reading through a post that will make people think. Also, thanks for allowing for me to comment!

Крючок-застежка для кормящих мам купить

Wow, that's what I was seeking for, what a information! present here at this weblog, thanks admin of this website.

Кулирка, ластовица купить

This site really has all of the info I wanted about this subject and didn't know who to ask.

Окантовочная резинка купить

Good post however , I was wondering if you could write a litte more on this topic? I'd be very grateful if you could elaborate a little bit more. Thanks!

Отделочная и становая резинка купить

Hello there, simply became aware of your blog thru Google, and found that it is really informative. I'm gonna watch out for brussels. I will appreciate for those who continue this in future. A lot of other folks will be benefited from your writing. Cheers!

Регилин купить

This is my first time visit at here and i am in fact happy to read all at one place.

Регуляторы купить

I will right away grasp your rss as I can not find your email subscription link or newsletter service. Do you have any? Please permit me realize so that I may just subscribe. Thanks.

Резинка бельевая вязаная купить

Wow, superb blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is great, let alone the content!

Резинка для белья и трусов купить

Have you ever considered about including a little bit more than just your articles? I mean, what you say is fundamental and all. Nevertheless just imagine if you added some great photos or video clips to give your posts more, "pop"! Your content is excellent but with images and clips, this website could undeniably be one of the most beneficial in its niche. Excellent blog!

Резинка латексная купить

My coder is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the expenses. But he's tryiong none the less. I've been using Movable-type on a number of websites for about a year and am anxious about switching to another platform. I have heard fantastic things about blogengine.net. Is there a way I can transfer all my wordpress content into it? Any kind of help would be really appreciated!

Сетка эластичная купить

I think what you postedtypedsaidbelieve what you postedtypedsaidthink what you postedwrotesaidthink what you postedtypedWhat you postedtyped was very logicala ton of sense. But, what about this?consider this, what if you were to write a killer headlinetitle?content?wrote a catchier title? I ain't saying your content isn't good.ain't saying your content isn't gooddon't want to tell you how to run your blog, but what if you added a titleheadlinetitle that grabbed a person's attention?maybe get people's attention?want more? I mean %BLOG_TITLE% is a little plain. You could peek at Yahoo's home page and see how they createwrite news headlines to get viewers to click. You might add a video or a related pic or two to get readers interested about what you've written. Just my opinion, it might bring your postsblog a little livelier.

Сетка неэластичная купить

What's up to all, as I am in fact keen of reading this blog's post to be updated regularly. It consists of pleasant data.

Тесьма с эластичными петлями купить

Good info. Lucky me I came across your website by accident (stumbleupon). I have bookmarked it for later!

Туннельная лента купить

I am really loving the theme/design of your site. Do you ever run into any internet browser compatibility problems? A number of my blog visitors have complained about my website not operating correctly in Explorer but looks great in Opera. Do you have any suggestions to help fix this issue?

Застежка для чулок купить

Wonderful goods from you, man. I've understand your stuff prior to and you're simply too magnificent. I really like what you've obtained here, really like what you're stating and the way during which you are saying it. You make it entertaining and you still take care of to stay it sensible. I can not wait to read far more from you. This is actually a terrific website.

Застежки для бюстгальтеров купить

This article will help the internet users for building up new blog or even a blog from start to end.

Металлическая застежка купить

I am really happy to read this webpage posts which contains lots of helpful data, thanks for providing such data.

Нейлоновая застежка купить

What's up mates, how is all, and what you wish for to say concerning this article, in my view its truly remarkable for me.

Пластиковая застежка купить

Fantastic beat ! I wish to apprentice while you amend your web site, how can i subscribe for a blog web site? The account aided me a acceptable deal. I had been tiny bit acquainted of this your broadcast provided bright clear concept

Тесьма с крючками купить

I am sure this post has touched all the internet users, its really really nice piece of writing on building up new website.

Фурнитура для шкатулок купить

Hi, i think that i saw you visited my website so i came to return the favor.I am trying to find things to improve my site!I suppose its ok to use some of your ideas!!

Крючки для заготовок купить

I'm not sure where you are getting your info, but good topic. I needs to spend some time learning more or understanding more. Thanks for great information I was looking for this information for my mission.

Qjfplz

ciprofloxacin sale - buy keflex 125mg without prescription buy augmentin 375mg without prescription

Srthvdaync

cozaar pictures

Xnrfiple

what is depakote er 500mg used for

Crhcgoogy

von willebrand disease type 1 ddavp

Rdlglr

order ciprofloxacin 500 mg online cheap - order ciprofloxacin 500 mg buy erythromycin generic

KmevAnode

citalopram.

Rgcnlo

buy flagyl online - order cefaclor 250mg without prescription buy azithromycin 500mg

Alavjs

ivermectin without prescription - order tetracycline 500mg online cheap sumycin oral

Fnocot

ivermectin 6mg for people - amoxiclav us order sumycin 500mg generic

Stehdaync

rash from augmentin

зарубежные сериалы смотреть онлайн

Ahaa, its pleasant conversation regarding this post here at this webpage, I have read all that, so now me also commenting here.

Xthdfiple

diclofenac sodium 75 mg tablets

Cjefgoogy

what is diltiazem er used for

Pvcgcj

buy valacyclovir sale - zovirax sale buy generic acyclovir

KxebAnode

sharp ezetimibe slides

Sedcdaync

flomax over the counter alternative

Birbas

ampicillin ca cost amoxil amoxil price

Xtmffiple

flexeril vs zanaflex

Cjmogoogy

contrave long term

Cbtiti

flagyl 200mg ca - buy cefaclor pill azithromycin canada

Srncdaync

amitriptyline for sleep and pain

Ctmvgoogy

aspirin medication

Ngomhf

order furosemide 40mg online cheap - order tacrolimus online purchase captopril generic

Xtenfiple

aripiprazole used for

Odwnrb

metformin online buy - buy duricef 500mg sale buy lincocin 500 mg online

KmtfAnode

lesinurad and allopurinol

Srmvdaync

bupropion hcl xl 150 mg weight loss

Zigdaz

clozaril 50mg usa - order famotidine 20mg generic brand famotidine 40mg

Csxxgoogy

augmentin for cats

Xssmnfiple

baclofen a controlled substance

KmrcAnode

best time to take celebrex

Yrtmuh

buy zidovudine 300 mg without prescription - buy glycomet generic buy zyloprim 300mg online cheap

Дублерин Гамма купить

Greetings! I know this is somewhat off topic but I was wondering which blog platform are you using for this site? I'm getting tired of Wordpress because I've had issues with hackers and I'm looking at options for another platform. I would be great if you could point me in the direction of a good platform.

Дублерин Гамма купить

Can I simply say what a relief to find an individual who really knows what they're talking about on the internet. You definitely understand how to bring an issue to light and make it important. More people have to read this and understand this side of the story. I can't believe you aren't more popular because you surely have the gift.

Флизелин Гамма купить

I will right away clutch your rss as I can not in finding your email subscription link or newsletter service. Do you have any? Please allow me understand so that I may subscribe. Thanks.

Флизелин Гамма купить

Hey there! Someone in my Myspace group shared this site with us so I came to give it a look. I'm definitely enjoying the information. I'm book-marking and will be tweeting this to my followers! Wonderful blog and great style and design.

Клеевые ленты купить

It's very easy to find out any topic on net as compared to books, as I found this article at this web site.

Клеевые ленты купить

This is a topic that's close to my heart... Many thanks! Where are your contact details though?

Паутинка купить

After checking out a few of the blog articles on your site, I really like your way of blogging. I saved it to my bookmark website list and will be checking back soon. Take a look at my web site as well and let me know how you feel.

Паутинка купить

Way cool! Some very valid points! I appreciate you writing this post and the rest of the site is very good.

Скотч двухсторонний для кожи Трансфер купить

We are a gaggle of volunteers and starting a new scheme in our community. Your site provided us with helpful information to work on. You have performed an impressive task and our whole group shall be grateful to you.

Скотч двухсторонний для кожи Трансфер купить

It's awesome in favor of me to have a web site, which is valuable for my knowledge. thanks admin

Кружево купить

I love your blog.. very nice colors & theme. Did you create this website yourself or did you hire someone to do it for you? Plz answer back as I'm looking to design my own blog and would like to know where u got this from. cheers

Кружево купить

Really no matter if someone doesn't understand then its up to other people that they will help, so here it happens.

Эластичное кружево купить

Thank you for any other informative web site. Where else may just I am getting that kind of info written in such a perfect means? I have a undertaking that I am simply now operating on, and I have been at the glance out for such information.

Эластичное кружево купить

I used to be recommended this blog through my cousin. I am now not sure whether this post is written by means of him as no one else recognise such specified approximately my difficulty. You are wonderful! Thank you!

Эластичное кружево 150-170 мм купить

Its like you read my mind! You seem to understand so much approximately this, like you wrote the ebook in it or something. I think that you could do with some p.c. to force the message house a bit, however other than that, this is great blog. A great read. I'll definitely be back.

Эластичное кружево 150-170 мм купить

Hi, I think your blog might be having browser compatibility issues. When I look at your blog site in Chrome, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, superb blog!

Эластичное кружево 15-50 мм купить

I simply could not leave your web site prior to suggesting that I extremely enjoyed the standard information a person supply in your visitors? Is going to be back ceaselessly in order to check out new posts

Sxxedaync

buspirone panic

Эластичное кружево 15-50 мм купить

Thank you for the auspicious writeup. It if truth be told used to be a entertainment account it. Glance complex to far brought agreeable from you! By the way, how can we communicate?

Эластичное кружево 175-190 мм купить

Hmm is anyone else experiencing problems with the images on this blog loading? I'm trying to find out if its a problem on my end or if it's the blog. Any feedback would be greatly appreciated.

Эластичное кружево 175-190 мм купить

Pretty nice post. I just stumbled upon your blog and wanted to say that I have really enjoyed browsing your blog posts. In any case I'll be subscribing to your feed and I hope you write again soon!

Эластичное кружево 195-210 мм купить

What a information of un-ambiguity and preserveness of precious familiarity regarding unexpected feelings.

Эластичное кружево 195-210 мм купить

The other day, while I was at work, my sister stole my iphone and tested to see if it can survive a 25 foot drop, just so she can be a youtube sensation. My iPad is now broken and she has 83 views. I know this is entirely off topic but I had to share it with someone!

Эластичное кружево 220 мм купить

Right now it seems like BlogEngine is the best blogging platform out there right now. (from what I've read) Is that what you're using on your blog?

Эластичное кружево 220 мм купить

hey there and thank you for your information I've definitely picked up anything new from right here. I did however expertise some technical issues using this web site, since I experienced to reload the site many times previous to I could get it to load properly. I had been wondering if your hosting is OK? Not that I am complaining, but sluggish loading instances times will often affect your placement in google and can damage your quality score if advertising and marketing with Adwords. Anyway I'm adding this RSS to my e-mail and can look out for a lot more of your respective interesting content. Make sure you update this again soon.

Эластичное кружево 230 мм купить

It's difficult to find knowledgeable people on this topic, but you sound like you know what you're talking about! Thanks

Эластичное кружево 230 мм купить

I do agree with all the concepts you have presented on your post. They are very convincing and will definitely work. Still, the posts are too brief for novices. May you please extend them a bit from next time? Thank you for the post.

Эластичное кружево 55-100 мм купить

Incredible points. Solid arguments. Keep up the good effort.

Гипюр купить

I always used to read post in news papers but now as I am a user of internet so from now I am using net for articles or reviews, thanks to web.

Гипюр купить

Thanks for sharing your thoughts on %meta_keyword%. Regards

Кружево гипюр 10-30 мм купить

Howdy I am so thrilled I found your site, I really found you by error, while I was researching on Askjeeve for something else, Nonetheless I am here now and would just like to say thank you for a fantastic post and a all round exciting blog (I also love the theme/design), I don't have time to go through it all at the minute but I have saved it and also added in your RSS feeds, so when I have time I will be back to read a lot more, Please do keep up the fantastic job.

Кружево гипюр 10-30 мм купить

I always used to read piece of writing in news papers but now as I am a user of internet so from now I am using net for articles or reviews, thanks to web.

Кружево гипюр 31-45 мм купить

Excellent post. I was checking continuously this blog and I am impressed! Very useful information specially the last part :) I care for such info a lot. I was seeking this particular info for a long time. Thank you and good luck.

Кружево гипюр 31-45 мм купить

Heya i'm for the primary time here. I came across this board and I find It truly useful & it helped me out a lot. I hope to provide something back and help others like you helped me.

Кружево гипюр 46-90 мм купить

I got this web site from my friend who informed me concerning this site and now this time I am visiting this site and reading very informative articles here.

Кружево гипюр 46-90 мм купить

It's really very complex in this busy life to listen news on TV, thus I simply use web for that purpose, and get the most recent news.

Кружево на сетке купить

Appreciating the hard work you put into your website and in depth information you present. It's great to come across a blog every once in a while that isn't the same outdated rehashed material. Fantastic read! I've saved your site and I'm including your RSS feeds to my Google account.

Кружево на сетке купить

You should take part in a contest for one of the highest quality blogs on the net. I will recommend this site!

Czzqgoogy

celexa vs paxil

Xncfiple

when to take ashwagandha

Fibqut

buy clomipramine 25mg sale - paxil 20mg oral how to get doxepin without a prescription

KmhhAnode

para que sirve el celecoxib 200 mg

Iepmki

quetiapine 100mg drug - sertraline 50mg tablet eskalith online

Beybpr

purchase hydroxyzine generic - nortriptyline 25 mg pill endep usa

Exhnns

buy augmentin 375mg generic - cipro tablet order ciprofloxacin 500mg generic

Srcbdaync

abilify and tardive dyskinesia

Uuyyzl

buy generic amoxil over the counter - purchase trimox online ciprofloxacin online order

Cjuugoogy

acarbose spc

Xtvcfiple

semaglutide starting dose

KrccAnode

actos valor

Sasfdaync

repaglinide drug profile pdf

Xjwfmt

order azithromycin 250mg - azithromycin over the counter order ciplox 500 mg generic

Czzugoogy

protonix withdrawal

Xmhfiple

robaxin and gabapentin

KxeeAnode

half life remeron

Iymiwu

buy generic cleocin - order vibra-tabs pills where to buy chloramphenicol without a prescription

Uyvnhm

ivermectin 3 mg for sale - purchase aczone online cheap order cefaclor 250mg pill

глаз бога телеграмм бесплатно

This is a topic that is close to my heart... Take care! Where are your contact details though?

Fvznqs

albuterol 2mg cost - buy seroflo inhalator generic theophylline 400mg price

Ebdiyt

buy depo-medrol generic - azelastine 10ml generic order astelin 10 ml

Awsxdaync

what is the medication classification of sitagliptin (januvia) quizlet

Bthjfiple

spironolactone in spanish

ZefbAnode

synthroid bluelight

Ibgisg

clarinex online - zaditor 1 mg cheap order albuterol

Rffxwk

purchase metformin without prescription - order losartan 50mg acarbose without prescription

Ayybdaync

is voltaren gel good for low back pain

Xnexew

buy glyburide medication - oral glipizide order forxiga 10 mg generic

Cnnygoogy

tizanidine 4mg dosage

Bbbffiple

venlafaxine coupon

ZolkAnode

tamsulosin diffundox

Ammhdaync

merck zetia coupon

Djtqev

prandin drug - prandin 1mg generic brand empagliflozin

Cndygoogy

zofran can you get high

Nvrmif

where to buy rybelsus without a prescription - buy cheap generic DDAVP order desmopressin for sale

ZoljAnode

zyprexa for anorexia

Bmoofiple

wellbutrin makes me depressed

Cndygoogy

how does zofran make you feel

Fkcfha

lamisil ca - purchase griseofulvin without prescription buy grifulvin v generic

ZoljAnode

half life zyprexa

Pcbfrq

buy famciclovir no prescription - acyclovir pill order valcivir

Dztrzo

buy ketoconazole 200mg sale - nizoral price buy itraconazole 100 mg sale

Sdkave

order digoxin 250 mg generic - buy digoxin 250mg generic buy lasix online

Ymlyxh

generic lopressor 100mg - order inderal online cheap adalat cheap

Teenet

order hydrochlorothiazide generic - buy bisoprolol pills buy zebeta 5mg sale

Axerdaync

generic levitra 20mg

Ccxygoogy

cialis pills online

Bcedfiple

levitra medication online

ZccrAnode

cialis benefits

Hinjxb

order simvastatin 10mg generic - atorvastatin fate atorvastatin knowledge

Icuhzm

nitroglycerin over the counter - indapamide 2.5mg brand buy valsartan 160mg sale

Krwboc

crestor online whether - zetia definite caduet online stray

Axerdaync

levitra discount cards

Ccxygoogy

tadalafil tablets erectafil 20

Bcedfiple

levitra tablets

Bhftdd

priligy servant - levitra with dapoxetine bay cialis with dapoxetine soup

ZccrAnode

cialis extra

Toajhu

viagra professional online shape - eriacta crouch levitra oral jelly wick

Amdbdaync

mexican pharmacy online

Agnnzg

brand cialis satisfy - penisole brother penisole borrow

Ctkogoogy

where to buy sildenafil

Wscdfiple

Desyrel

cs 2 skins gamble website 2024

Howdy just wanted to give you a quick heads up. The text in your content seem to be running off the screen in Firefox. I'm not sure if this is a format issue or something to do with internet browser compatibility but I thought I'd post to let you know. The layout look great though! Hope you get the problem solved soon. Kudos

ZbuiAnode

zydenafil vs sildenafil

Gusvjs

cenforce jack - tadalafil cost brand viagra shove

Umtbss

brand cialis hesitate - tadora candle penisole squeeze

Blrcal

cialis soft tabs pills big - tadarise pills traffic viagra oral jelly remain

Amdbdaync

cialis pharmacy

Wscdfiple

your pharmacy online

Ctkogoogy

sildenafil coupon

Byvzhp

cialis soft tabs pills arise - cialis oral jelly pills swarm viagra oral jelly online charge

Гомельский государственный университет имени Франциска Скорины

Xcdtqv

dapoxetine fasten - zudena pot cialis with dapoxetine flag

Ertsul

cenforce online before - zenegra online protest brand viagra online sam

Wrorgk

asthma treatment float - inhalers for asthma ash asthma medication stir

Acxzdaync

levitra dosage vardenafil

Cuemnn

acne treatment virtue - acne medication announce acne treatment lay

Itepsh

prostatitis pills know - prostatitis treatment mistake prostatitis medications pressure

Wsnrfiple

vardenafil zhewitra 20

Akedgoogy

can you drink wine or liquor if you took in tadalafil

ZnrfAnode

tadalafil india online

Hihrdz

uti antibiotics sore - uti antibiotics downward treatment for uti unseen

Dzjpnn

claritin pills howl - claritin pills dim loratadine dislike

Гостиничные Чеки СПБ купить

Good day! Do you know if they make any plugins to help with SEO? I'm trying to get my blog to rank for some targeted keywords but I'm not seeing very good results. If you know of any please share. Thank you!

Udlnyx

priligy freeze - dapoxetine stomach priligy section

Gptztm

claritin give - loratadine depend claritin article

Cqrsew

ascorbic acid supply - ascorbic acid steward ascorbic acid glisten

купить удостоверение тракториста машиниста

Right now it sounds like Drupal is the top blogging platform out there right now. (from what I've read) Is that what you're using on your blog?

ZnrfAnode

buy tadalafil tablets

Yduntx

promethazine museum - promethazine look promethazine love

Qowhyh

biaxin teach - mesalamine match cytotec display

Ormcym

florinef chapter - esomeprazole astonish prevacid hall

乱伦色情

Everything is very open with a clear explanation of the issues. It was really informative. Your website is very helpful. Thanks for sharing!

Ffudug

buy rabeprazole pills - aciphex price brand motilium

Bmmggv

order generic rabeprazole - buy maxolon without prescription buy motilium generic

Brxdna

order dulcolax 5 mg generic - buy generic loperamide online purchase liv52 generic

Qsuvxu

where to buy zovirax without a prescription - buy generic desogestrel over the counter order dydrogesterone 10 mg sale

Wggjtr

cotrimoxazole 960mg uk - order tobra 5mg generic buy tobrex 5mg

Dvgrqh

buy griseofulvin pills - dipyridamole for sale online order lopid 300mg for sale

www.russa24-diploms-srednee.com

Right now it seems like Expression Engine is the top blogging platform out there right now. (from what I've read) Is that what you're using on your blog?

Acxzdaync

vardenafil tablets in india

Ecxgtj

buy generic forxiga online - buy dapagliflozin 10mg for sale precose 25mg without prescription

Gwjujd

dramamine 50mg pill - order actonel 35mg generic buy risedronate 35mg online cheap

ZnrfAnode

tadalafil cialis from india

хот фиеста game

I know this if off topic but I'm looking into starting my own blog and was wondering what all is required to get set up? I'm assuming having a blog like yours would cost a pretty penny? I'm not very internet savvy so I'm not 100% sure. Any recommendations or advice would be greatly appreciated. Kudos

Atmbdaync

relenza online pharmacy

Jombxp

brand monograph - order pletal 100 mg online cheap pletal 100 mg

Scktmr

buy enalapril online - order doxazosin 2mg without prescription latanoprost tubes

Wndbfiple

indian pharmacy tramadol

Aebggoogy

tramadol is online pharmacy

ZmrAnode

reputable indian pharmacies

дэдди казино регистрация

Hi, this weekend is pleasant designed for me, as this point in time i am reading this wonderful informative post here at my house.

Cyqxko

piroxicam online buy - purchase rivastigmine generic buy rivastigmine 3mg generic

Atmbdaync

geodon online pharmacy

Aebggoogy

omeprazole pharmacy

Wndbfiple

indian pharmacy valium

ZmrAnode

good neighbor pharmacy naproxen

7k казино сайт

This is a topic that's close to my heart... Take care! Where are your contact details though?

Clemmie

As the admin of this web site is working, no uncertainty very rapidly it will be renowned, due to its quality contents.

Jiywpv

buy hydroxyurea generic - buy cheap hydroxyurea methocarbamol 500mg cheap

Теннис онлайн

I simply could not depart your site prior to suggesting that I really enjoyed the standard information a person supply in your visitors? Is going to be back regularly in order to inspect new posts

Lmkwyd

depakote 500mg ca - buy amiodarone cheap topiramate 200mg usa

Kmfcru

norpace order - chlorpromazine online pill thorazine 50 mg

Ekbdys

aldactone medication - order phenytoin online cheap purchase revia pills

Прогнозы на футбол

I know this if off topic but I'm looking into starting my own blog and was wondering what all is required to get set up? I'm assuming having a blog like yours would cost a pretty penny? I'm not very internet savvy so I'm not 100% sure. Any recommendations or advice would be greatly appreciated. Thank you

Vxvqmi

oral cytoxan - brand meclizine cost vastarel

Dzjgqu

buy cyclobenzaprine 15mg without prescription - cheap donepezil pill enalapril generic

строительство автомоек под ключ

Автомойка под ключ - простой путь к своему бизнесу. Получите современное, энергоэффективное и привлекательное для клиентов предприятие.

Yflvbb

ascorbic acid 500mg over the counter - cost ciprodex ophthalmic solution buy compro online cheap

Kahfje

generic zofran - cheap oxytrol generic ropinirole 2mg usa

Прогнозы на футбол

Thanks for a marvelous posting! I actually enjoyed reading it, you could be a great author. I will make sure to bookmark your blog and definitely will come back in the foreseeable future. I want to encourage you to definitely continue your great writing, have a nice weekend!

Wavzqx

buy durex gel - order durex condoms online buy generic zovirax for sale

Jmcovl

order minoxidil online - finpecia over the counter order generic proscar

Jlaonl

cheap verapamil 240mg - buy diovan cheap tenoretic without prescription

Ckmnpu

arava online order - purchase calcium carbonate without prescription order cartidin sale

Dpvrjl