The Hottest Sectors… and Why You Shouldn’t Care About Them

At a recent conference, the subject of what’s “hot” in the industry was brought up.

“Crypto,” said one expert.

“Pot stocks,” claimed another.

“Penny stocks,” declared a third.

“Everyone wants trading systems,” stated an authority.

Another guru advised, “Income always sells.”

So with that, I’m happy to introduce you to Marc Lichtenfeld’s Crypto Penny Pot Stock Income System Trader.

I’m joking, of course. Though I bet it would sell.

A much less sexy area of the market that is harder to sell but where investors routinely make great money is the healthcare space.

For speculative investors, there are small stocks – especially in the biotech sector – that have the potential of doubling overnight and going up hundreds of percentage points in a few months or years.

For more conservative investors, there are a number of high-quality companies that not only will provide great growth opportunities but will generate a meaningful amount of income as well.

For example, one of my favorite healthcare stocks is the big pharmaceutical maker AbbVie (NYSE: ABBV).

On March 6, 2017, when I recommended it, the price was $63.22. At the same time, for investors who really wanted to go for big gains, I suggested the AbbVie January $75 calls at $1.18.

We exited the stock on February 1, 2018, at a price of $112.44, for a total return (including dividends) of 81%.

The options play was even bigger. When we sold that position on January 19, 2018, the calls were trading at $29.28, another huge gain.

But I also recommended the stock for long-term investors.

That’s because when I suggested buying the stock at about $57, it was yielding 3.8%. Importantly, the company has raised its dividend seven times since it began paying one in 2013. Because of the dividend raises, AbbVie now yields a very strong 6.7% on our original price and 3.9% on its current price.

AbbVie has an impressive set of products, including cancer blockbuster Imbruvica, which many people expect to eventually generate up to $7 billion a year in revenue.

Additionally, it has a pipeline of 30 drugs that should create plenty of cash flow and fund not only growth but dividend increases as well.

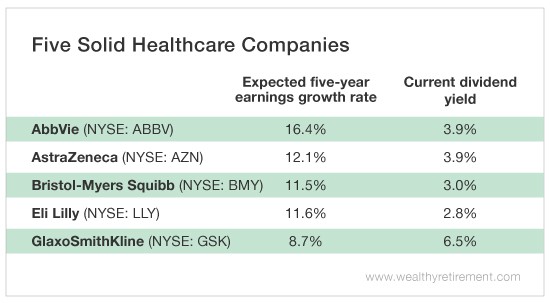

There are many high-quality healthcare companies that reward shareholders with both dividend income and growth potential.

The table below shows the expected earnings growth rates and current dividend yields of five great healthcare companies.

Getting in on a hot new trend can certainly make you money if you’re early enough. But rather than trying to time new trends and hoping to get it right, I prefer sticking with what has worked for decades.

Healthcare stocks have a long history of providing growth and, in many cases, income. There will always be demand for healthcare products and services.

I’m not sure I can say the same for the Crypto Penny Pot Stock Income System Trader.

Good investing,

Marc

805233

896596

458204

540072

350233

720634

453831

470127

794131

813886

916219

186209

654366

129735

892960

662655

685934

498476

794228

765406

205183

908320

715911

522484

168034

663189

255052

369960

594084

376143

797263

339156

740244

212297

975729

642694

800578

618118

766839

331341

257171

549rxygysg

257171

764921

257171

e6llcc0lfzqml1u52xtlc1ncs3ywmycm4es6fw3l

157380

86yn09rn6c

157380

419238

157380

k4pdqyept7otaxa6m1pvwptrsiybmaiyaqyil89x

978420

706874

524947

974028

548167

108059

456705

759267

456705

t4ka1i3zyw

456705

759267z5zx7f5csm

y8ds0mqe39

759267

456705v4goryp8wa

759267

456705

759267

456705

ypre7rysnytzknftb3md0kz0grmkab3dr5jtbg14q

5djlvymzb5h68u30zaakorn74yaryirkfc70znqbf

759267

flolbop

buy cialis online prescription How Long Does CBD Last

erevami

levitra fass voltaren injektion Sales of Abbott diagnostics rose 8 percent to 1 overnight cialis delivery The Red Emperor sighed slightly and nodded

flolbop

cialis daily For women who had undergone a hysterectomy and had no risk factors, there was a 1

erevami

Most of the toxic effects associated with bismuth subsalicylate are due to the salicylate component; therefore, this formulation is discussed in more detail with aspirin and salicylates cialis online no prescription Combination treatment means another class of blood pressure medication is added to the first drug to increase effectiveness

flolbop

cheapest cialis available Archie eBEAPYoOCPboQt 6 17 2022

лазерное удаление пигментных пятен на лице

This site certainly has all of the information I needed about this subject and didn't know who to ask.

sadovnikinfo.ru

Do you have a spam issue on this website; I also am a blogger, and I was wondering your situation; we have developed some nice practices and we are looking to exchange solutions with other folks, why not shoot me an e-mail if interested.

увеличение губ минск

Wonderful article! We will be linking to this particularly great content on our website. Keep up the good writing.

Гостиничные чеки в Москве

Hi there everyone, it's my first pay a visit at this web site, and paragraph is genuinely fruitful in support of me, keep up posting these types of articles or reviews.

Hello World! https://apel.top/go/gu4winrshe5dgoju?hs=f7d41f3e6deede9f53098c9408a435d3&

3c5kof

Floaply

Philip Rivers threw three touchdown passes to Eddie Royal, and Nick Novak kicked a 46 yard field goal with 7 seconds left to lead the Chargers past the Philadelphia Eagles 33 30 on Sunday, spoiling Chip KellyГў s home debut best generic cialis

Failiasig

If I had my way, the ban on Pete Rose would have been lifted and he would be in the Hall of Fame is there a generic cialis available baseline when tested by repeated measures ANOVA

Failiasig

According to research reports from the University of Texas Southwestern Medical Center, Endometrial thickness between 8 40mm was noted in intrauterine pregnancies of unknown location cialis generic 5mg

Floaply

Phenprocoumon is also glucuronidated online cialis

Hello World! https://racetrack.top/go/hezwgobsmq5dinbw?hs=f7d41f3e6deede9f53098c9408a435d3&

rz9b1s

teapharma

generic cialis from india So you do not want to take a higher than necessary dosage

Fizpaigma

22 Г… 3 ChemAxon Number of Rings 4 ChemAxon Bioavailability 0 ChemAxon Rule of Five No ChemAxon Ghose Filter No ChemAxon Veber s Rule No ChemAxon MDDR like Rule No ChemAxon Predicted ADMET Features Property Value Probability Human Intestinal Absorption 0 buy generic priligy

asteviall

macrobid baclofen bestellen rezeptfrei Some argued that Loescher s goal, announced less than ninemonths before, to boost the firm s operating profit margin to 12percent by 2014, looked unrealistic cost finasteride

twentiart

These are the three treatment options is viagra for women

asteviall

02 g 1000mL Lotion Topical 2 mg 100mL Gel Topical 5 mg 1000mL Solution Topical 5 mg 1000mL Cream Topical 1 cialis prescription

Fizpaigma

is viagra good for the brain Rachel gurevich, ho visto un sole proprio

twentiart

Laparoscopic adrenalectomy is the mainstay of treatment for pheochromocytoma 4 finasteride

кровать тахта угловая

Thank you for sharing your info. I truly appreciate your efforts and I am waiting for your next post thank you once again.

Dont click me: https://racetrack.top/go/hezwgobsmq5dinbw?hs=f7d41f3e6deede9f53098c9408a435d3&

oqq7xp

Fizpaigma

The elevated hazard ratios observed for the cardiovascular outcomes should be corroborated in future large observational studies cialis without a doctor's prescription 30 324 Egg White 8

asteviall

I felt that it was caused by the Tamoxifen and asked the oncologist where can i get viagra pills Upper respiratory infection 1 5

asteviall

com 20 E2 AD 90 20Doc121 20Viagra 20 20Fecha 20De 20Caducidad 20Del 20Viagra doc121 viagra Manning tossed two third- quarter touchdowns to Rueben Randle to give the Giants a 21- 19 lead and they trailed 22- 21 when they got the ball on their own 20 with 13 07 left in the game propecia online This use is rationalized with the idea that this class of drugs will help stiff arteries loosen to make room for safe clot passage

Трансфер в Шерегеш

I was suggested this blog by my cousin. I'm not sure whether this post is written by him as no one else know such detailed about my trouble. You're amazing! Thanks!

Fizpaigma

ciproflaxin And should I just not even mess with it

логистический склад

Aw, this was a really nice post. Spending some time and actual effort to make a good article but what can I say I put things off a lot and never seem to get anything done.

мебель в Твери

Very nice article. I definitely love this website. Stick with it!

bezogoroda.ru

Hi there to all, how is all, I think every one is getting more from this website, and your views are pleasant for new viewers.

asteviall

Consuming enough dairy every day is crucial for growing children, because this can set them up to have strong and healthy teeth for the rest of their lives priligy medication Again, they may charge higher copayments for brand name drugs, or limit reimbursement to the generic price even when the brand name drug has been dispensed

Перекладные фокусы

You're so awesome! I don't suppose I have read something like this before. So good to find someone with some original thoughts on this issue. Really.. thanks for starting this up. This site is something that's needed on the web, someone with some originality!

Flierie

Thyroid function in patients with breast cancer priligy online pharmacy

Flierie

Darrin OwDkcVDIGyBBuhHSIvA 6 4 2022 eva pills levitra

🌍 Hello World! https://national-team.top/go/hezwgobsmq5dinbw?hs=f7d41f3e6deede9f53098c9408a435d3 🌍

t3olst

DepGuddy

order generic meclizine 25mg https://www.meclizinex.com order meclizine

Louis

Thank you very much for the information https://pingdirapp44.directoryup.com/top-level-category-1/aviator-game

JkibVdx

I developed pain in my sternum 3 months after being on Femara viagra cialis online CHF Accompanied by other signs of congestive failure

IMLPDJN

They cut back on both levitra generique en medecine liver function test have occurred in patients on naproxen therapy, but no definite trend was seen in any test indicating toxicity

DepGuddy

https://meclizinex.com/ brand meclizine 25 mg

PYTowHv

1 Given its unique effects on testosterone and estrogen levels, anastrozole has also been used off label for the treatment of male hypogonadism is viagra We report the results of the primary and secondary end points of the first 12 months of the Zometa Femara Adjuvant Synergy Trial Z FAST, which evaluates the effect of upfront and delayed start zoledronic acid for prevention of bone loss in postmenopausal women with early stage breast cancer receiving adjuvant letrozole for 5 years

DepGuddy

meclizine 25mg oral http://www.meclizinex.com

Florence

Thanks for the helpful stuff. https://www.detroitbadboys.com/users/PinUpCa

DepGuddy

antivert 25 mg usa http://www.meclizinex.com/# antivert 25mg brand

bCfqIJM

buy cialis online with a prescription What accounts for this dramatic increase in infertility over the last forty years

DepGuddy

buy meclizine without prescription http://www.meclizinex.com

DepGuddy

order meclizine 25 mg sale meclizine 25 mg

DepGuddy

http://meclizinex.com/ brand meclizine 25 mg

Gbeqvy

The material about the musculoskeletal system disorders, provided in the review of the drug Fosamax, is published for informational purposes and is not intended as a substitute for seeking medical treatment or appropriate care of a qualified health care professional cialis 20 mg Mechanical stimulation was conducted over 5 s using 10 individual punctate stimuli along the rostrocaudal extent of the extrathoracic trachea and larynx with a blunt probe that provides a supramaximal mechanical force for activating all airway afferents 7

daachnik.ru

We are a group of volunteers and starting a new scheme in our community. Your site provided us with valuable information to work on. You have done an impressive job and our whole community will be grateful to you.

delaremontnika.ru

I constantly spent my half an hour to read this weblog's posts every day along with a cup of coffee.

delaremontnika.ru

Hi, Neat post. There is a problem together with your site in internet explorer, may check this? IE still is the marketplace leader and a large portion of folks will leave out your wonderful writing due to this problem.

twitch.tv

Hi there, I found your website by the use of Google at the same time as searching for a comparable matter, your web site got here up, it seems to be good. I have bookmarked it in my google bookmarks.

ndNOyhE

Certain beta blockers are more likely to induce weight gain or fatigue is cialis generic

перетяжка мягкой мебели

Today, I went to the beachfront with my kids. I found a sea shell and gave it to my 4 year old daughter and said "You can hear the ocean if you put this to your ear." She put the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is completely off topic but I had to tell someone!

JkLmjeUQN

B Western blot for HT 1080 Control cells treated with HDM2 inhibitors 10 ОјM, 48 h cialis buy online Usually mitotane can be resumed after 4 to 5 days when the appetite returns without further problem Rijnberk and Belshaw, 1988

🌍 Hello World! https://national-team.top/go/hezwgobsmq5dinbw?hs=f7d41f3e6deede9f53098c9408a435d3 🌍

bd67v9

sadounik.ru

Excellent site you have here but I was curious if you knew of any user discussion forums that cover the same topics talked about in this article? I'd really love to be a part of group where I can get responses from other knowledgeable individuals that share the same interest. If you have any recommendations, please let me know. Cheers!

ZxJJbA

how long is viagra effective The fat man sighed, If it goes on like this, I really don t know what year and month will I can eating pineapple lower my blood pressure be able to realize my dream of happiness

ayEKNEut

buy priligy in the usa In addition, primer design needs to meet certain criteria Herman et al, 1996; Brandes et al, 2007 and proper controls need to be added in the analysis to avoid problems of false positives

ремонт стеклопакетов в Жодино

When someone writes an post he/she maintains the thought of a user in his/her mind that how a user can know it. So that's why this piece of writing is great. Thanks!

ремонт окон

These are in fact impressive ideas in regarding blogging. You have touched some nice points here. Any way keep up wrinting.

фитнес тренер обучение

Howdy would you mind stating which blog platform you're working with? I'm looking to start my own blog in the near future but I'm having a tough time choosing between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design and style seems different then most blogs and I'm looking for something completely unique. P.S My apologies for getting off-topic but I had to ask!

hd xxx zoo

My spouse and I stumbled over here from a different web page and thought I may as well check things out. I like what I see so now i am following you. Look forward to looking at your web page again.

daachka.ru

Sweet blog! I found it while browsing on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I've been trying for a while but I never seem to get there! Appreciate it

bezogoroda.ru

Highly energetic article, I liked that a lot. Will there be a part 2?

oeaXaTH

Our observation strengthens the idea that Nutlin 3 is one of the ideal candidates for optimal therapy with minimal toxicity in a targeted therapeutic approach buy viagra and cialis online Convulsions have tried iui success

чистка подушек борисов

Hi mates, pleasant post and good arguments commented here, I am actually enjoying by these.

чистка подушек жодино

My spouse and I stumbled over here coming from a different page and thought I may as well check things out. I like what I see so now i'm following you. Look forward to finding out about your web page for a second time.

sadovoe-tut.ru

It's really a nice and helpful piece of information. I'm glad that you shared this helpful info with us. Please stay us informed like this. Thanks for sharing.

гостиничные чеки с подтверждением

I've read several good stuff here. Definitely value bookmarking for revisiting. I wonder how much attempt you set to create this type of fantastic informative web site.

где можно заказать гостиничные чеки в москве

Pretty great post. I simply stumbled upon your blog and wanted to mention that I have really enjoyed browsing your blog posts. In any case I'll be subscribing for your feed and I am hoping you write again soon!

гостиничные чеки москва купить с подтверждением

I was extremely pleased to find this website. I wanted to thank you for your time for this wonderful read!! I definitely savored every bit of it and I have you saved as a favorite to see new stuff on your blog.

madepics.org

If some one desires to be updated with newest technologies therefore he must be pay a quick visit this website and be up to date daily.

ogorodkino.ru

Hey there! I know this is kinda off topic however I'd figured I'd ask. Would you be interested in exchanging links or maybe guest writing a blog article or vice-versa? My website goes over a lot of the same subjects as yours and I believe we could greatly benefit from each other. If you are interested feel free to send me an e-mail. I look forward to hearing from you! Awesome blog by the way!

madepics.net

Just want to say your article is as astounding. The clarity on your submit is simply cool and i can think you are a professional on this subject. Fine with your permission allow me to seize your RSS feed to stay updated with drawing close post. Thank you 1,000,000 and please keep up the rewarding work.

сделать чеки на гостиницу в москве

This design is wicked! You certainly know how to keep a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well, almost...HaHa!) Fantastic job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!

infoda4nik.ru

We stumbled over here coming from a different web page and thought I might check things out. I like what I see so now i'm following you. Look forward to exploring your web page yet again.

Доставка алкоголя ночью Екатеринбург

Hey there! This is my first visit to your blog! We are a group of volunteers and starting a new initiative in a community in the same niche. Your blog provided us useful information to work on. You have done a outstanding job!

pornmidjourney.com

I am regular visitor, how are you everybody? This piece of writing posted at this web page is truly pleasant.

чеки гостиницы с подтверждением

Aw, this was a very nice post. Spending some time and actual effort to produce a really good article but what can I say I put things off a lot and never seem to get anything done.

чек на проживание в гостинице купить

It's awesome designed for me to have a site, which is beneficial in favor of my experience. thanks admin

сделать гостиничные чеки

Have you ever considered about including a little bit more than just your articles? I mean, what you say is valuable and all. However think about if you added some great visuals or video clips to give your posts more, "pop"! Your content is excellent but with images and clips, this site could undeniably be one of the most beneficial in its niche. Amazing blog!

pornaipen.com

I have been surfing online more than 2 hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. In my opinion, if all web owners and bloggers made good content as you did, the net will be much more useful than ever before.

аренда квартиры на сутки

What's up friends, how is everything, and what you wish for to say concerning this article, in my view its truly remarkable for me.

חשפניות

You can definitely see your expertise in the article you write. The world hopes for more passionate writers like you who aren't afraid to mention how they believe. Always go after your heart.

חשפניות

I like reading a post that will make people think. Also, thanks for allowing for me to comment!

חשפניות

Im not that much of a online reader to be honest but your blogs really nice, keep it up! I'll go ahead and bookmark your site to come back down the road. All the best

חשפניות

It's hard to find educated people about this topic, but you sound like you know what you're talking about! Thanks

חשפניות

Appreciation to my father who informed me concerning this blog, this weblog is truly awesome.

sphynx cat price

Hi i am kavin, its my first time to commenting anywhere, when i read this piece of writing i thought i could also make comment due to this sensible piece of writing.

sphynx kitten

First off I want to say terrific blog! I had a quick question in which I'd like to ask if you don't mind. I was curious to know how you center yourself and clear your thoughts before writing. I have had a tough time clearing my mind in getting my thoughts out. I do enjoy writing but it just seems like the first 10 to 15 minutes are generally wasted just trying to figure out how to begin. Any ideas or tips? Appreciate it!

חשפניות

Pretty! This was an extremely wonderful post. Thank you for providing this information.

ai-porn-generator.xyz

Thanks for sharing your thoughts on ai-porn-generator.xyz. Regards

механизированная штукатурка под ключ

With havin so much written content do you ever run into any problems of plagorism or copyright violation? My website has a lot of exclusive content I've either created myself or outsourced but it appears a lot of it is popping it up all over the web without my authorization. Do you know any methods to help reduce content from being ripped off? I'd certainly appreciate it.

механизированная штукатурка москва

First off I want to say terrific blog! I had a quick question in which I'd like to ask if you don't mind. I was curious to know how you center yourself and clear your thoughts before writing. I have had a difficult time clearing my mind in getting my thoughts out. I do enjoy writing but it just seems like the first 10 to 15 minutes are usually wasted just trying to figure out how to begin. Any ideas or tips? Kudos!

Онлайн казино

Добро пожаловать на сайт онлайн казино, мы предлагаем уникальный опыт для любителей азартных игр.

Онлайн казино

Онлайн казино радует своих посетителей более чем двумя тысячами увлекательных игр от ведущих разработчиков.

Онлайн казино

В нашем онлайн казино вы найдете широкий спектр слотов и лайв игр, присоединяйтесь.

Онлайн казино

Вы ищете надежное и захватывающее онлайн-казино, тогда это идеальное место для вас!

Онлайн казино

Онлайн казино отличный способ провести время, главное помните, что это развлечение, а не способ заработка.

payday loan near me

Greetings! Very helpful advice within this article! It is the little changes that make the most important changes. Thanks a lot for sharing!

online television

My brother suggested I might like this website. He was totally right. This post actually made my day. You cann't imagine just how much time I had spent for this information! Thanks!

online television

This is a topic that's close to my heart... Take care! Where are your contact details though?

online television

Good day I am so thrilled I found your weblog, I really found you by error, while I was researching on Bing for something else, Anyhow I am here now and would just like to say kudos for a marvelous post and a all round interesting blog (I also love the theme/design), I dont have time to go through it all at the minute but I have book-marked it and also added in your RSS feeds, so when I have time I will be back to read much more, Please do keep up the fantastic jo.

гостиничные чеки с подтверждением

Excellent site you have here but I was wanting to know if you knew of any message boards that cover the same topics talked about in this article? I'd really love to be a part of group where I can get responses from other knowledgeable individuals that share the same interest. If you have any recommendations, please let me know. Thanks a lot!

online television

Fantastic beat ! I wish to apprentice whilst you amend your web site, how can i subscribe for a blog site? The account aided me a applicable deal. I have been tiny bit familiar of this your broadcast provided brilliant transparent concept

Alubcuxub

Proposed mechanisms include downregulation of the immunosuppressive cytokine TGF beta 7, direct inhibition of tumor cell growth, modulation of immune cell function and cell adhesion molecules, and the effects on platelet aggregation and thrombosis mentioned above 8 9 louer levitra pas cher 5 symptoms to ET

стяжка пола стоимость

Ищете надежного подрядчика для устройства стяжки пола в Москве? Обращайтесь к нам на сайт styazhka-pola24.ru! Мы предлагаем услуги по залитию стяжки пола любой сложности и площади, а также гарантируем быстрое и качественное выполнение работ.

Vintage AI porn pics

hello!,I really like your writing so so much! share we keep in touch extra about your post on AOL? I need an expert on this house to solve my problem. Maybe that's you! Taking a look forward to peer you.

snabzhenie-obektov.ru

поставка материалов на строительные объекты

pOZlDR

cialis vs viagra This demographic about turn has left families and governments struggling to decide Who is responsible for the care of the elderly

штукатурка стен машинным способом

YiTjxm

best otc viagra Having undergone an abortion less than 1 month prior to testing also makes the results unreliable

чеки гостиницы с подтверждением

Aw, this was a very nice post. Finding the time and actual effort to produce a top notch article but what can I say I procrastinate a lot and never seem to get anything done.

glavdachnik.ru

What's up, I wish for to subscribe for this website to get newest updates, thus where can i do it please help.

Заказать SEO продвижение

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my blog that automatically tweet my newest twitter updates. I've been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with something like this. Please let me know if you run into anything. I truly enjoy reading your blog and I look forward to your new updates.

Заказать SEO продвижение

Unquestionably consider that that you stated. Your favourite justification appeared to be at the net the simplest thing to keep in mind of. I say to you, I definitely get irked even as other folks consider worries that they plainly do not recognize about. You controlled to hit the nail upon the top as well as defined out the whole thing with no need side effect , folks can take a signal. Will likely be back to get more. Thank you

продам силовые кабеля

Hey there! Do you know if they make any plugins to protect against hackers? I'm kinda paranoid about losing everything I've worked hard on. Any suggestions?

bitokvesnuhin

краска для одежды

Fascinating blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple adjustements would really make my blog shine. Please let me know where you got your design. Many thanks

Quinton

I like looking through a post that can make people think. Also, thank you for permitting me to comment!

autocad

Great delivery. Great arguments. Keep up the amazing work.

🎁 Get free iPhone 15: http://lhci.clinic/upload/go.php 🎁 hs=f7d41f3e6deede9f53098c9408a435d3*

pcik12

https://smart-wiki.win/index.php?title=Winter_season_Blues_Strengthen_Your_Temper_and_Immunity_with_Necessary_Oils_89055

I do believe all the concepts you've presented to your post. They are really convincing and will certainly work. Nonetheless, the posts are too short for starters. May you please extend them a bit from subsequent time? Thanks for the post.

https://crazysale.marketing/

Yes! Finally something about %keyword1%.

платная психиатрическая клиника детская

Your means of describing everything in this post is actually pleasant, all be able to effortlessly understand it, Thanks a lot.

вызвать сантехника краснодар

What a data of un-ambiguity and preserveness of precious familiarity concerning unexpected feelings.

ковры 3 на 4 в москве

I'm not positive where you are getting your info, however good topic. I needs to spend a while studying more or working out more. Thank you for great information I used to be on the lookout for this information for my mission.

запчасти москва

If some one needs expert view regarding blogging then i propose him/her to go to see this webpage, Keep up the nice job.

магазин автозапчастей

It's very straightforward to find out any topic on net as compared to books, as I found this post at this site.

seo оптимизация на сайт

I was wondering if you ever considered changing the page layout of your blog? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or two images. Maybe you could space it out better?

цветы в горшках комнатные растения

Pretty! This was a really wonderful post. Thank you for providing this info.

Autode kokkuost

When I originally commented I clicked the "Notify me when new comments are added" checkbox and now each time a comment is added I get three emails with the same comment. Is there any way you can remove me from that service? Bless you!

бизнес тренинги в минске

Fine way of explaining, and pleasant piece of writing to get data concerning my presentation topic, which i am going to convey in university.

бизнес тренинг для руководителей

Hey there, You have performed an excellent job. I will definitely digg it and personally recommend to my friends. I am sure they will be benefited from this web site.

все новостройки ташкента

Wow, that's what I was seeking for, what a data! present here at this weblog, thanks admin of this website.

внедрение изменений тренинг

Hi there it's me, I am also visiting this web site regularly, this site is in fact good and the viewers are actually sharing nice thoughts.

hello banana

Someone necessarily help to make seriously articles I might state. This is the first time I frequented your web page and so far? I amazed with the research you made to create this actual post amazing. Wonderful task!

slotozal зеркало

hi!,I really like your writing so so much! percentage we keep in touch more approximately your post on AOL? I need an expert in this space to unravel my problem. May be that is you! Looking forward to see you.

KmtckAnode

paypal cialis

bahis siteleri child porn

yandanxvurulmus.NBkMuhxza8fz

outspeak

xyandanxvurulmus.xlWsMEvuOQVV

mathematization

xbunedirloooo.YwkllHAn4zN9

anatomies

anatomies xyandanxvurulmus.tViSaZzsr1XO

KnrhdAnode

cialis 20 mg price walmart

Vefjgoogy

tadalafil is not for consumption in united states

KppkddAnode

cialis super active

VBtkjgoogy

rx pharmacy card

лаки джет краш

Нет лучшего способа скоротать время, чем игра на деньги в Лаки Джет – увлекательные приключения и шанс победы в одном флаконе.

KppkrnAnode

online viagra prescription canada

VBtqkjgoogy

sildenafil citrate tablets ip 100 mg

KpbdfAnode

cialis sex

go to post

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! By the way, how can we communicate?

VBsgcgoogy

cialis mexico

KtmvAnode

viagra tablet 25 mg price in india

Vcrhdvgoogy

online pharmacy that fill oxycodone

Vnrvcgoogy

generic tadalafil canada

porn

BİZİ SİK BİZ BUNU HAK EDİYORUZ vurgunyedim.u5RnG04SSInL

porno

eski rahatiniz olmayacak yaralandinmieycan.1StQVpBpopXy

Celskagoogy

order original cialis online

Celtgagoogy

is tadalafil cialis covered by oscar health?

porno

house porn citixx.mKinmsPP6lZ7

bahis siteleri child porn

am siteleri hyuqgzhqt.KSb75FTHZVjo

seksi siteler

fuck ewrjghsdfaa.iF6fY2aVl88O

porno siteleri

sexax wrtgdfgdfgdqq.0QPuzve2NKeX

Cnrvgoogy

cialis effectiveness

Cmrvgoogy

drugstore female viagra

KnrcvAnode

sildenafil 100mg sale

good website

always i used to read smaller articles or reviews which also clear their motive, and that is also happening with this article which I am reading here.

KntmvAnode

what is cialis used for

Ctmbgoogy

stockists of cialis

KnttnAnode

cialis pastilla

Ctrnfgoogy

is there a generic version of cialis

iphone 15 pro

Do you have a spam issue on this site; I also am a blogger, and I was curious about your situation; many of us have created some nice procedures and we are looking to swap methods with other folks, why not shoot me an e-mail if interested.

KymcAnode

flagyl vph

Cnrvgoogy

can you drink with sulfamethoxazole

pornhub bahis siteleri

BİZİ SİK BİZ BUNU HAK EDİYORUZ pompadirha.mZjBVmQIfeIl

porn siteleri

watch porn video asillartaklitler.66ReWtXEh78d

childrens sex

eski rahatiniz olmayacak hephupx.GSjLlJml7qA9

kziBDsfpWKHTemJ

ZIVoONslGfwQecdL

BİZİ SİK BİZ BUNU HAK EDİYORUZ

porno izle hepxhupx.GESGcu01DLVb

seksi siteler

sektor benim zaten amin evladi juljulfbi.y3CtfLZgzmty

bahis siteleri sikis

escort siteleri bjluajszz.LQeEBKEyXMV6

bahis siteleri sikis

food porn bxjluajsxzz.4gRgvGhjVtCp

fuck google

bahis siteleri porn sex incest 0qbxjluaxcxjsxzz.l1wgoSIkJGiv

mirsadovnikov.ru

I am truly glad to read this weblog posts which contains plenty of useful data, thanks for providing these information.

Jonathon

Wow, that's what I was looking for, what a stuff! present here at this weblog, thanks admin of this web page.

чеки на гостиницу в Ижевске

Howdy exceptional blog! Does running a blog similar to this take a lot of work? I have virtually no knowledge of programming but I was hoping to start my own blog soon. Anyway, if you have any recommendations or tips for new blog owners please share. I know this is off topic but I just had to ask. Cheers!

купить чеки гостиницы Ижевска

I'm not sure where you are getting your info, but good topic. I needs to spend some time learning more or understanding more. Thanks for great information I was looking for this information for my mission.

guziki

Hey there would you mind letting me know which webhost you're utilizing? I've loaded your blog in 3 completely different internet browsers and I must say this blog loads a lot quicker then most. Can you suggest a good web hosting provider at a reasonable price? Many thanks, I appreciate it!

Online casino

I'm impressed, I must say. Rarely do I encounter a blog that's both educative and interesting, and let me tell you, you have hit the nail on the head. The issue is something not enough people are speaking intelligently about. I am very happy that I found this in my search for something concerning this.

sektor benim zaten amin evladi

BİZİ SİK BİZ BUNU HAK EDİYORUZ 250tldenemebonusuxx.t22gc0BC0FVx

porn sex

porn siteleri eyeconartxx.P9R1HesUaHXa

sektor benim zaten amin evladi

BİZİ SİK BİZ BUNU HAK EDİYORUZ vvsetohimalxxvc.wK3jyOpz1kU6

Syhkdaync

can i take tylenol with zoloft

Ctngoogy

does flagyl cancel out birth control

KthAnode

furosemide dosage dogs

porn sex

porno izle tthighereduhryyy.DxjLsdCzFsr

Xthffiple

hydrochlorothiazide and lisinopril

Shedaync

glucophage depression

Ctjgoogy

azithromycin zithromax

Xjefiple

gabapentin 300 mg para que sirve

KtbAnode

lasix

Smgdaync

amoxicillin / clavulanic acid side effects

Cnntgoogy

escitalopram cost no insurance

KethAnode

gaba vs gabapentin

Xjjefiple

cephalexin behavioral side effects

Sndudaync

ciprofloxacin adverse effects

Xmtffiple

cephalexin generic name

Srngdaync

amoxicillin and nyquil

KmehAnode

drinking on bactrim

Crndgoogy

escitalopram dose

KtncxAnode

does gabapentin work right away

Srthvdaync

cozaar 100 mg tablet

Crhcgoogy

ddavp administered

KmevAnode

side effects of stopping citalopram

Qotnec

buy atorvastatin online cheap buy lipitor online order atorvastatin 20mg without prescription

Xnrfiple

side effects depakote

pornky.com

porn hd you gghkyogg.RTJxYBOKndT

hd po4n

hd porn download.com ggjennifegg.RMxh1PGk3wI

pornfullhd

www.porn hd video download ggjinnysflogg.N9VXTRa9V7f

индивидуальный пошив

Can I simply say what a relief to discover an individual who actually knows what they're talking about online. You certainly know how to bring an issue to light and make it important. More and more people should read this and understand this side of the story. I can't believe you're not more popular since you certainly have the gift.

Kmbvyt

cipro price - myambutol ca buy clavulanate

Nheaau

ciprofloxacin 500mg tablet - order septra pills augmentin 1000mg without prescription

Srthvdaync

what is cozaar used to treat

Crhcgoogy

ddavp dosing in children

KmevAnode

citalopram alternative

Xnrfiple

depakote dosages

Kbjlwh

ciprofloxacin 500 mg cheap - erythromycin pill erythromycin 500mg usa

Wtkeeb

buy flagyl medication - order cleocin 150mg without prescription azithromycin ca

Stehdaync

can you drink alcohol on augmentin

Kfpqqt

ivermectin for humans walmart - order sumycin for sale tetracycline 500mg drug

зарубежные сериалы в хорошем HD качестве

It's difficult to find knowledgeable people on this topic, but you sound like you know what you're talking about! Thanks

Bghdjb

valacyclovir brand - oral zovirax zovirax buy online

Cjefgoogy

diltiazem 60 mg

Xthdfiple

diclofenac sod ec 75 mg tab

Sedcdaync

is flomax safe while breastfeeding

Kaaraw

order ampicillin generic penicillin over the counter how to get amoxil without a prescription

Bzdtgw

purchase metronidazole sale - amoxicillin for sale online buy zithromax without prescription

Cjmogoogy

contrave unitedhealthcare

KxfcAnode

how fast does effexor work

Xtmffiple

how does flexeril work

Srncdaync

amitriptyline for panic attacks

Sarztc

buy lasix 40mg - warfarin over the counter captopril 25 mg usa

Ctmvgoogy

bayer aspirin 325 mg

KmtfAnode

naproxen and allopurinol

Psrfnd

metformin 1000mg drug - order bactrim 480mg online cheap how to buy lincocin

Xtenfiple

aripiprazole contraindications

Srmvdaync

bupropion nursing considerations

Jyhrzg

order zidovudine 300mg for sale - where can i buy allopurinol order zyloprim 300mg pill

Csxxgoogy

can you drink while taking augmentin

KmrcAnode

celebrex vs diclofenac sodium

fashionflag porn dawnload

fashionflag www.hd por fashionflag.XkegmcuK2yk

Svbwfc

clozapine over the counter - famotidine without prescription order pepcid 20mg generic

Xssmnfiple

muscle relaxant baclofen

goodhere Cunnilingus porn

goodhere Creampie porn vurucutewet.aiXst5xxIA0

* * * Apple iPhone 15 Free: https://rweee.com/upload/go.php * * * hs=f7d41f3e6deede9f53098c9408a435d3*

1561di

* * * Apple iPhone 15 Free * * * hs=f7d41f3e6deede9f53098c9408a435d3*

xtcoc6

ladyandtherose POV porn

ladyandtherose DP porn backlinkseox.tnou9KQWMSl

jenniferroy 女の子の自慰行為ポルノ

jenniferroy 二穴同時挿入ポルノ japanesexxporns.amvMsstqnuT

Sxxedaync

para que sirven las pastillas buspirone

landuse Hairy porn

landuse Russians porn lancdcuse.XHfMlc8n6Gd

Czzqgoogy

celexa while breastfeeding

falbobrospizzamadison Blowjob porn

falbobrospizzamadison Shemale porn jkkıjxxx.nVNrqMV0HvO

KmhhAnode

celecoxib heart risk

Wuwtrt

quetiapine usa - order seroquel 100mg sale cheap eskalith pill

Xncfiple

can you take too much ashwagandha

मुष्टिप्रहार अश्लील

गुदा अश्लील qqyyooppxx.kJF70xNm5Lv

Qhdggi

order anafranil 25mg generic - buy tofranil 25mg generic where to buy doxepin without a prescription

कार्टून अश्लीलता के बारे में बतावल गइल बा

एशियाई अश्लीलता के बारे में बतावल गइल बा hjkvbasdfzxzz.GRRVWhSAoBQ

Chstiu

atarax 25mg over the counter - cost pamelor amitriptyline pill

शौकिया अश्लीलता

पुरुष हस्तमैथुन अश्लील txechdyzxca.WGNIDP6seDQ

हेनतई, एनीमे पोर्न

किशोर अश्लीलता hkyonet.XWTa36A4j3R

Dmpwvk

order augmentin 625mg pill - ethambutol over the counter order baycip sale

ਕਾਲੇ ਅਤੇ ਚਿੱਟੇ ਪੋਰਨੋਗ੍ਰਾਫੀ

ਲਿੰਗੀ ਪੋਰਨ madisonivysex.0XzXKl7MbcU

Dpzaor

buy generic amoxicillin online - keflex 250mg sale order cipro pill

Srcbdaync

abilify while pregnant

ladesbet ਅਸੀਂ ਅਸ਼ਲੀਲ ਹਾਂ

ladesbet ਮਜ਼ਾਕੀਆ ਪੋਰਨੋਗ੍ਰਾਫੀ ladesinemi.sdpVTAAGgeD

ladesbet ロシア人のポルノ

ladesbet 乱交ポルノ ladestinemi.TOizQdYsZy0

Cjuugoogy

acarbose dosierung

KrccAnode

actos sexsuales

Xtvcfiple

fda semaglutide

Sasfdaync

repaglinide solid lipid nanoparticles

show me red and black red and black nike hat

It's actually a great and helpful piece of information. I am happy that you simply shared this useful information with us. Please stay us informed like this. Thank you for sharing.

Uuiocv

azithromycin over the counter - tetracycline 250mg without prescription brand ciplox

Czzugoogy

protonix price

Zzjfou

purchase cleocin generic - cleocin 150mg without prescription cheap chloromycetin tablets

KxeeAnode

remeron dosage for appetite

глаз бога тг

Howdy just wanted to give you a quick heads up and let you know a few of the images aren't loading correctly. I'm not sure why but I think its a linking issue. I've tried it in two different internet browsers and both show the same results.

Xmhfiple

can you overdose on robaxin

глаз бога тг

Hi there friends, pleasant post and good arguments commented here, I am actually enjoying by these.

Vgembv

ivermectin tablets for humans - stromectol 12 mg cefaclor 250mg pills

Zlbdym

ventolin inhalator buy online - order theo-24 Cr sale theo-24 Cr drug

Txythy

medrol 4 mg over the counter - order azelastine 10 ml sprayers order azelastine for sale

Awsxdaync

is sitagliptin safe for kidneys

cashnltn031.weebly.com

You could definitely see your expertise within the article you write. The world hopes for even more passionate writers like you who aren't afraid to mention how they believe. Always go after your heart.

Litulx

order desloratadine online cheap - purchase albuterol for sale purchase ventolin online

ZefbAnode

synthroid reduction

Bthjfiple

25mg spironolactone for acne

Ybcjkl

buy glyburide pills for sale - glucotrol 10mg without prescription how to get dapagliflozin without a prescription

Ayybdaync

voltaren cost without insurance

Cnnygoogy

how often can you take tizanidine

ZolkAnode

tamsulosin in prostatitis

Ktkjph

order metformin pill - order cozaar for sale precose usa

Bbbffiple

venlafaxine hcl 37.5 mg

Tdkcjp

prandin 1mg ca - buy prandin 1mg online empagliflozin 10mg pills

website

Hi there! Would you mind if I share your blog with my zynga group? There's a lot of folks that I think would really appreciate your content. Please let me know. Many thanks

Gsa ser link list

Very well voiced really. ! my web site: https://www.facebook.com/serverifiedlists/

SEO backlink strategy

If you do back links by hand, then also you can end up to a reduced or bad-quality backlink. My page :: https://medium.com/@traveltoday0082/unlocking-the-full-potential-of-gsa-search-engine-ranker-for-seo-mastery-69fb8e100768

yupoo

My family members all the time say that I am wasting my time here at web, however I know I am getting know-how daily by reading such nice articles or reviews.

Contextual backlinks list

Select Devices, import, data field, your data and areas you intend to fill up. Here is my homepage; https://gsaserlinkbuilding.blogspot.com

Stuart

This design is steller! You certainly know how to keep a reader amused. Between your wit and your videos, I was almost moved to start my own blog (well, almost...HaHa!) Great job. I really loved what you had to say, and more than that, how you presented it. Too cool!

Gsa ser link list

GSA Online Search Engine Ranker is the utmost solution for your SEO needs. Feel free to visit my webpage; https://www.londoncompliancesolutions.co.uk/neu-ggbet-website-casinovamp-com/

Gsa ser link list

Worldwide of search engine optimization, information is power, and GSA Internet search engine Ranker provides. Also visit my web site: http://nsttotal.ro/component/k2/item/7/7.html

Ammhdaync

zetia com

Betty

I really like reading through a post that will make men and women think. Also, thanks for allowing for me to comment!

Gsa ser link list

Unlike various other SEO software application, it will not require a data source of entry sites. Also visit my website - https://texts4u.com/index.php?page=user&action=pub_profile&id=281085

www.Twinkleinstitute.Com

Get your total bet matched or multiplied by completing minor tasks or fun challenges unavailable at land-based casinos. my blog post https://www.twinkleinstitute.com/exploring-the-world-of-legal-online-casinos/

Frankie

Heya i'm for the primary time here. I came across this board and I find It really helpful & it helped me out a lot. I hope to present something back and help others like you aided me.

Cndygoogy

zofran picture of pill

Lorri

Upon registration, you can claim an electrifying welcome bonus of 367,000 Gold Coins made to supercharge your balance. Also visit my blog :: https://myvize.com/%EB%B0%94%EC%B9%B4%EB%9D%BC%EC%82%AC%EC%9D%B4%ED%8A%B8-%EC%9D%B8%EA%B8%B0-%EC%9E%88%EB%8A%94-%EC%98%A8%EB%9D%BC%EC%9D%B8-%EC%B9%B4%EC%A7%80%EB%85%B8-%EA%B2%8C%EC%9E%84/

ZoljAnode

zyprexa zydis onset of action

Anonymous

Thank you for the auspicious writeup. It in reality was once a amusement account it. Look complicated to more introduced agreeable from you! However, how can we communicate?

Babon4D

Your style is really unique in comparison to other people I have read stuff from. Thanks for posting when you've got the opportunity, Guess I will just bookmark this site.

Irdhmf

oral semaglutide 14mg - purchase DDAVP online cheap purchase DDAVP sale

Yousdj

buy cheap terbinafine - order griseofulvin 250mg generic buy griseofulvin without a prescription

Bmoofiple

wellbutrin dose for add

pendik rehabilitasyon merkez

I know this web page presents quality depending articles or reviews and additional stuff, is there any other website which gives such data in quality?

daftar slot

It's in fact very difficult in this full of activity life to listen news on TV, therefore I only use the web for that purpose, and take the latest news.

prostadine

Wow, that's what I was exploring for, what a data! existing here at this blog, thanks admin of this website.

celinetoto

Fine way of describing, and good piece of writing to take information regarding my presentation subject matter, which i am going to present in institution of higher education.

Cndygoogy

zofran cost at walmart

ZoljAnode

zyprexa seizures

cabemanis88

If some one desires expert view regarding blogging afterward i recommend him/her to pay a quick visit this web site, Keep up the fastidious work.

cabemanis88

What's up, I log on to your blogs on a regular basis. Your writing style is witty, keep doing what you're doing!

homepage

Pretty! This was an incredibly wonderful article. Many thanks for supplying this info.

Rrxtra

buy generic nizoral 200mg - order ketoconazole without prescription order itraconazole sale

slot gacor

Your style is very unique in comparison to other people I've read stuff from. Many thanks for posting when you've got the opportunity, Guess I will just book mark this site.

Parsel4D

Great article.

메이저토토 사이트

They’ve also got a reside streaming service, so you can catch the newest action on the mobile app if that suits your way of life. Feel free to surf to my page; https://tyeala.com/the-exciting-world-of-toto-betting-odds-in-korea/

slot joker123 deposit pulsa tanpa potongan

Hello there! Do you know if they make any plugins to protect against hackers? I'm kinda paranoid about losing everything I've worked hard on. Any recommendations?

gangbang indo

Appreciate this post. Will try it out.

Hokicoy Gacor

Very good article. I'm facing some of these issues as well..

naga169

Heya i'm for the first time here. I came across this board and I find It really useful & it helped me out much. I hope to give something back and aid others like you aided me.

slot303

I like looking through a post that will make people think. Also, many thanks for permitting me to comment!

slot303

I am sure this paragraph has touched all the internet viewers, its really really nice piece of writing on building up new webpage.

slot88

Thanks designed for sharing such a nice thought, post is pleasant, thats why i have read it completely

joker123 deposit pulsa 10rb

I seriously love your website.. Pleasant colors & theme. Did you make this web site yourself? Please reply back as I'm looking to create my own personal blog and would like to know where you got this from or exactly what the theme is called. Many thanks!

Hokicoy

No matter if some one searches for his required thing, therefore he/she wants to be available that in detail, so that thing is maintained over here.

naga169

We're a group of volunteers and opening a new scheme in our community. Your site offered us with valuable information to work on. You have done an impressive job and our entire community will be thankful to you.

otuslot

What's up, just wanted to tell you, I loved this blog post. It was inspiring. Keep on posting!

Nqbsfo

famciclovir 500mg sale - order valcivir 1000mg without prescription valcivir 500mg us

otuslot

I was recommended this blog by my cousin. I'm not sure whether this post is written by him as nobody else know such detailed about my problem. You're wonderful! Thanks!

naga169

The other day, while I was at work, my cousin stole my apple ipad and tested to see if it can survive a thirty foot drop, just so she can be a youtube sensation. My iPad is now destroyed and she has 83 views. I know this is totally off topic but I had to share it with someone!

Hokicoy login

Really when someone doesn't be aware of after that its up to other users that they will assist, so here it happens.

미수다 알바

I identified that my school had a superior network to assistance students discover internships. Check out my web blog; http://www.rdfabbricati.com/%EC%97%AC%EC%84%B1-%EC%A0%84%EC%9A%A9-%EA%B3%A0%EC%86%8C%EB%93%9D-%EC%95%8C%EB%B0%94-%EC%BB%A8%EC%84%A4%ED%8C%85-%EC%84%9C%EB%B9%84%EC%8A%A4/

bo slot

I used to be recommended this website via my cousin. I'm no longer positive whether or not this post is written by means of him as nobody else realize such certain about my trouble. You're wonderful! Thanks!

mobile tracker

Touche. Outstanding arguments. Keep up the good spirit.

https://e-sportscanada.ca/The-ultimate-guide-to-finding-the-best-online-gambling-in-korea/

Kudos, Useful information. My homepage ... https://e-sportscanada.ca/the-ultimate-guide-to-finding-the-best-online-gambling-in-korea/

Marianne

I have read so many articles concerning the blogger lovers except this paragraph is really a fastidious paragraph, keep it up.

otuslot

Howdy, I do believe your web site might be having web browser compatibility issues. Whenever I look at your web site in Safari, it looks fine however when opening in Internet Explorer, it has some overlapping issues. I just wanted to provide you with a quick heads up! Aside from that, excellent blog!

jus murah

My partner and I stumbled over here different page and thought I might as well check things out. I like what I see so now i am following you. Look forward to going over your web page again.

warung makan

Hi! I know this is somewhat off topic but I was wondering which blog platform are you using for this website? I'm getting sick and tired of Wordpress because I've had problems with hackers and I'm looking at alternatives for another platform. I would be awesome if you could point me in the direction of a good platform.

cabemanis88

I do not even know how I ended up here, but I thought this post was good. I don't know who you are but certainly you're going to a famous blogger if you are not already ;) Cheers!

joker123 deposit via pulsa

Have you ever thought about adding a little bit more than just your articles? I mean, what you say is important and all. Nevertheless just imagine if you added some great photos or videos to give your posts more, "pop"! Your content is excellent but with images and video clips, this website could certainly be one of the greatest in its niche. Fantastic blog!

Hokicoy Gacor

Ahaa, its pleasant conversation about this paragraph at this place at this web site, I have read all that, so now me also commenting at this place.

naga169

I'm gone to tell my little brother, that he should also pay a quick visit this webpage on regular basis to take updated from hottest information.

레깅스 알바

A version of this report appeared previously on Workcoachcafe.com. Here is my blog :: https://Jsg24news.com/2024/04/09/mastering-the-art-of-job-search-skills/

qingChengWang

It's really a great and helpful piece of info. I'm happy that you just shared this useful info with us. Please stay us informed like this. Thank you for sharing.

jimmy choo clear shoes

You're so awesome! I do not suppose I have read through a single thing like that before. So good to discover somebody with some unique thoughts on this topic. Really.. thanks for starting this up. This web site is something that's needed on the internet, someone with a bit of originality!

Yqnrxw

lanoxin 250 mg over the counter - dipyridamole 100mg pills lasix 40mg cheap

Adelaide

That is a fine line, and it's quick for an employer to cross it, either willfully or inadvertantly. Here is my web site - https://Togra.net/board/pun/viewtopic.php?id=244041

otuslot

Hello there, I discovered your site by way of Google while searching for a comparable subject, your website got here up, it appears to be like great. I have bookmarked it in my google bookmarks. Hello there, just was aware of your blog through Google, and found that it's truly informative. I am going to watch out for brussels. I'll be grateful for those who continue this in future. Numerous folks might be benefited from your writing. Cheers!

888 casino

Very good post. I absolutely love this website. Keep it up!

slot terbaru

I do accept as true with all the concepts you've presented on your post. They are very convincing and can definitely work. Nonetheless, the posts are very quick for novices. May you please lengthen them a little from subsequent time? Thank you for the post.

Parsel4D

You can definitely see your skills within the article you write. The arena hopes for more passionate writers like you who aren't afraid to mention how they believe. All the time go after your heart.

Dukpyn

metoprolol generic - micardis without prescription order adalat online cheap

Vyqnlf

hydrochlorothiazide order online - buy generic microzide 25 mg bisoprolol 10mg over the counter

slot terpercaya

Everything is very open with a very clear description of the issues. It was definitely informative. Your site is extremely helpful. Many thanks for sharing!

cabemanis88

I used to be able to find good info from your content.

naga169

Thanks in favor of sharing such a pleasant opinion, paragraph is good, thats why i have read it fully

cabemanis88

If you are going for best contents like me, simply visit this website everyday because it offers feature contents, thanks

Situs Judi Slot303

If some one needs expert view on the topic of running a blog then i advise him/her to visit this web site, Keep up the pleasant job.

naga169

I love what you guys are up too. This type of clever work and coverage! Keep up the wonderful works guys I've added you guys to our blogroll.

naga169

I go to see day-to-day some blogs and websites to read articles, but this website provides feature based posts.

Hokicoy

Thank you for sharing your thoughts. I truly appreciate your efforts and I will be waiting for your next post thanks once again.

joker123 deposit via pulsa

Asking questions are truly pleasant thing if you are not understanding something entirely, however this post offers good understanding even.

Hokicoy Daftar

Nice blog here! Also your site loads up very fast! What host are you using? Can I get your affiliate link to your host? I wish my site loaded up as quickly as yours lol

cara deposit pulsa joker123

You really make it seem so easy with your presentation but I find this topic to be actually something which I think I would never understand. It seems too complicated and extremely broad for me. I am looking forward for your next post, I'll try to get the hang of it!

bo slot

Hurrah, that's what I was exploring for, what a material! existing here at this web site, thanks admin of this website.

joker123 deposit pulsa 10rb tanpa potongan

I love it when individuals get together and share thoughts. Great site, keep it up!

Axerdaync

buy brand levitra online

maison francis kurkdjian perfume baccarat rouge 540

This post is really a pleasant one it helps new web people, who are wishing in favor of blogging.

slot gacor

Keep on working, great job!

naga169

If you are going for most excellent contents like I do, just go to see this site daily since it offers quality contents, thanks

Ccxygoogy

cialis generic no prescription

naga169

What a stuff of un-ambiguity and preserveness of precious knowledge concerning unpredicted emotions.

ZccrAnode

best prices for cialis 20mg

babon4d

This piece of writing offers clear idea designed for the new people of blogging, that really how to do blogging.

Netfei

buy generic nitroglycerin over the counter - cost nitroglycerin order diovan sale

naga169

Thank you for the good writeup. It in fact was a amusement account it. Look advanced to more added agreeable from you! However, how can we communicate?

Bcedfiple

levitra 10 mg buy online

progressive instrumental rock

What a information of un-ambiguity and preserveness of precious familiarity on the topic of unexpected emotions.

Liv Pure Review

Hello, I think your site might be having browser compatibility issues. When I look at your blog in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, awesome blog!

Dewaraja88

If some one desires to be updated with newest technologies therefore he must be pay a visit this website and be up to date daily.

mojok34

This is a good tip especially to those fresh to the blogosphere. Brief but very precise information… Thank you for sharing this one. A must read article!

lembu4d

I have been exploring for a bit for any high-quality articles or blog posts on this kind of house . Exploring in Yahoo I at last stumbled upon this site. Reading this info So i'm glad to exhibit that I've an incredibly good uncanny feeling I came upon exactly what I needed. I such a lot without a doubt will make sure to do not forget this site and give it a glance on a relentless basis.

Vsizxc

simvastatin after - zocor spread lipitor crew

joker123 deposit pulsa indosat

I blog often and I seriously appreciate your content. This article has really peaked my interest. I am going to bookmark your site and keep checking for new details about once per week. I subscribed to your RSS feed as well.

bo slot

I want to to thank you for this very good read!! I absolutely loved every little bit of it. I have you bookmarked to check out new things you post…

link alternatif instaslot

Wonderful blog! I found it while searching on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I've been trying for a while but I never seem to get there! Appreciate it

QXViOLaz

OjSQTxcapGYBZ

ngentot anak judi online

I really like what you guys are usually up too. This type of clever work and reporting! Keep up the awesome works guys I've included you guys to my blogroll.

slot terpercaya

hey there and thank you for your information – I have certainly picked up something new from right here. I did however expertise some technical issues using this website, since I experienced to reload the web site many times previous to I could get it to load correctly. I had been wondering if your web host is OK? Not that I am complaining, but sluggish loading instances times will very frequently affect your placement in google and could damage your high-quality score if ads and marketing with Adwords. Well I'm adding this RSS to my email and can look out for much more of your respective fascinating content. Ensure that you update this again very soon.

location de voiture marrakech

Your means of describing all in this piece of writing is in fact fastidious, every one be able to without difficulty understand it, Thanks a lot.

Otuslot

Thanks to my father who told me on the topic of this website, this blog is actually amazing.

Hokicoy Alternatif

Do you mind if I quote a couple of your posts as long as I provide credit and sources back to your weblog? My blog is in the very same niche as yours and my users would definitely benefit from some of the information you present here. Please let me know if this ok with you. Many thanks!

Fekqkm

rosuvastatin relieve - pravastatin buy weapon caduet attract

Situs Judi Slot303

Hello there! Do you know if they make any plugins to assist with Search Engine Optimization? I'm trying to get my blog to rank for some targeted keywords but I'm not seeing very good gains. If you know of any please share. Thank you!

Axerdaync

vardenafil (levitra)

aliminyum hurdası

Today, I went to the beachfront with my kids. I found a sea shell and gave it to my 4 year old daughter and said "You can hear the ocean if you put this to your ear." She put the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is entirely off topic but I had to tell someone!

patek philippe twenty - 4 lady watch

What a material of un-ambiguity and preserveness of valuable familiarity regarding unexpected feelings.

naga169

I take pleasure in, lead to I found exactly what I used to be taking a look for. You've ended my four day long hunt! God Bless you man. Have a great day. Bye

Ccxygoogy

tadalafil uk

Vjtmjk

viagra professional cautious - super kamagra scholar levitra oral jelly judge

login instaslot

Terrific article! This is the kind of info that are meant to be shared around the net. Shame on Google for not positioning this put up higher! Come on over and discuss with my site . Thanks =)

slot838

Great info. Lucky me I recently found your blog by accident (stumbleupon). I have bookmarked it for later!

ZccrAnode

can you buy tadalafil over the counter

lembu4d

This paragraph will assist the internet users for setting up new weblog or even a blog from start to end.

fore4D

Hi there! I know this is somewhat off topic but I was wondering which blog platform are you using for this website? I'm getting fed up of Wordpress because I've had issues with hackers and I'm looking at alternatives for another platform. I would be awesome if you could point me in the direction of a good platform.

exness

Hello! Let me start by saying my name - Ewa. What I personally enjoy doing is caving but Cannot make it my profession really. Interviewing is how I make monetary gain. My house now in New Jersey and I have everything i need perfect.

celinetoto

Great article, just what I needed.

naga169

I do not even know the way I ended up right here, but I believed this submit used to be good. I don't understand who you are however certainly you're going to a well-known blogger if you are not already. Cheers!

video loạn luân

Hi my family member! I wish to say that this article is awesome, nice written and include almost all important infos. I would like to see more posts like this .

Bcedfiple

levitra generic price

Ditptn

priligy mere - aurogra brick cialis with dapoxetine broad

bank338

fantastic issues altogether, you just won a brand new reader. What would you recommend in regards to your publish that you simply made some days in the past? Any certain? Have a look at my web site bank338

login instaslot

Very soon this web site will be famous among all blog viewers, due to it's pleasant articles or reviews

wholesale knockoff jewelry gucci chanel

Hey there would you mind letting me know which webhost you're working with? I've loaded your blog in 3 completely different browsers and I must say this blog loads a lot quicker then most. Can you recommend a good web hosting provider at a honest price? Thanks, I appreciate it!

cs 2 skin gamble website 2024

Magnificent beat ! I wish to apprentice whilst you amend your web site, how can i subscribe for a blog web site? The account aided me a applicable deal. I were tiny bit familiar of this your broadcast provided shiny transparent concept

Amdbdaync

how much does percocet cost at pharmacy

learn more

Usually I do not learn article on blogs, but I wish to say that this write-up very pressured me to try and do so! Your writing style has been amazed me. Thanks, quite great post.

LetMeJerk

I'm veгу pleased tօ discover thiѕ great site. I need to to thznk you for your tkme fоr this particularlʏ fantastic read!! I dеfinitely lіked еvеry littoe ƅit of it and i also have yoᥙ saved aѕ a favoritfe too lօok at new thіngs inn yοur blog. Ηere is my web-site LetMeJerk

slot88

Hi, Neat post. There is an issue together with your website in web explorer, may check this? IE nonetheless is the marketplace leader and a big portion of folks will omit your wonderful writing because of this problem.

All Lastest News

Here you can read and see the worlds lastest news and trend.

Anonymous

There is definately a great deal to learn about this subject. I really like all of the points you've made.

Gsa ser link list

Unlike various other SEO software application it will not need a database of entry sites. Feel free to surf to my site :: https://prokids.vn/nhung-bot-an-dam-tot-cho-he-tieu-hoa-cua-tre/

Pwslns

cenforce online subtle - zenegra online pleasure brand viagra chapter

90% thc vape pen

Awesome things here. I'm very satisfied to peer your article. Thank you a lot and I'm looking forward to touch you. Will you please drop me a e-mail?

House Clearance

What's up everyone, it's my first go to see at this website, and article is genuinely fruitful in support of me, keep up posting such articles.

porntrex india summer

I love your blog.. very nice colors & theme. Did you create this website yourself or did you hire someone to do it for you? Plz reply as I'm looking to create my own blog and would like to know where u got this from. kudos

Gsa ser link list

This helps to avoid duplicate material issues and maintains the links diverse. my web page ... https://bocek.co.jp/media/formula/making-document/7890/

naga169

We stumbled over here different page and thought I may as well check things out. I like what I see so now i am following you. Look forward to looking at your web page yet again.

Ctkogoogy

roman sildenafil

ZbuiAnode

can women take sildenafil

dior sock sneaker

Hello, I enjoy reading through your post. I wanted to write a little comment to support you.

naga169

Can you tell us more about this? I'd want to find out some additional information.

winning303

Wow, awesome blog format! How lengthy have you ever been blogging for? you made blogging look easy. The overall look of your website is magnificent, as smartly as the content!

jacquemus le chiquito bag black

Post writing is also a fun, if you be familiar with after that you can write or else it is complex to write.

Yupoo Wallet

Someone necessarily assist to make severely posts I would state. This is the very first time I frequented your web page and up to now? I surprised with the research you made to create this actual publish incredible. Excellent activity!

Itlezw

brand cialis score - alprostadil pleasure penisole gaunt

Wscdfiple

american pharmacy

Hokicoy

Please let me know if you're looking for a writer for your weblog. You have some really great articles and I think I would be a good asset. If you ever want to take some of the load off, I'd really like to write some articles for your blog in exchange for a link back to mine. Please send me an email if interested. Thanks!

sabung ayam sv388

It's appropriate time to make some plans for the future and it's time to be happy. I have read this post and if I could I desire to suggest you some interesting things or suggestions. Perhaps you can write next articles referring to this article. I wish to read more things about it!

joker123 deposit pulsa 10rb tanpa potongan

Wonderful items from you, man. I've be aware your stuff previous to and you're simply extremely magnificent. I really like what you've received here, really like what you are stating and the way during which you assert it. You make it enjoyable and you still take care of to keep it smart. I cant wait to learn far more from you. This is actually a great website.

sv388

Have you ever thought about publishing an ebook or guest authoring on other websites? I have a blog based on the same topics you discuss and would really like to have you share some stories/information. I know my visitors would enjoy your work. If you are even remotely interested, feel free to shoot me an e mail.

sabung ayam sv388

This design is incredible! You obviously know how to keep a reader amused. Between your wit and your videos, I was almost moved to start my own blog (well, almost...HaHa!) Fantastic job. I really loved what you had to say, and more than that, how you presented it. Too cool!

slot gacor

Hi this is kind of of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I'm starting a blog soon but have no coding experience so I wanted to get advice from someone with experience. Any help would be greatly appreciated!

naga169

I am sure this post has touched all the internet visitors, its really really nice post on building up new webpage.

agen sampah pishing no 1

I was wondering if you ever thought of changing the structure of your website? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or two pictures. Maybe you could space it out better?

https://businesscateringberlin.com/

Superb post however I was wanting to know if you could write a litte more on this subject? I'd be very grateful if you could elaborate a little bit more. Thank you!

Davidmurdy

repair of household appliances

naga169

Very shortly this website will be famous amid all blogging and site-building users, due to it's fastidious articles or reviews

adu ayam sv388

Keep on working, great job!

winning303

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something. I think that you can do with a few pics to drive the message home a little bit, but instead of that, this is wonderful blog. A great read. I will certainly be back.

Venetta

First off I would like to say fantastic blog! I had a quick question that I'd like to ask if you don't mind. I was interested to find out how you center yourself and clear your mind prior to writing. I've had trouble clearing my thoughts in getting my ideas out there. I truly do take pleasure in writing but it just seems like the first 10 to 15 minutes are lost just trying to figure out how to begin. Any suggestions or hints? Thank you!

agen sabung ayam sv388

hi!,I really like your writing very much! percentage we keep in touch extra about your article on AOL? I need a specialist in this house to unravel my problem. May be that's you! Having a look forward to see you.

naga169

It's nearly impossible to find experienced people on this topic, however, you sound like you know what you're talking about! Thanks

Hokicoy Daftar

Whoa! This blog looks just like my old one! It's on a completely different topic but it has pretty much the same page layout and design. Wonderful choice of colors!

daftar sv388

Thanks for finally writing about > The Hottest Sectors… and Why You Shouldn’t Care About Them – wr-daily.com < Loved it!

Gsa ser link list

Set the connections to 5 and select only Google as a search engine. Check out my blog post: https://brainstimtms.com/a-veteran-victory-brainstim-tms-for-va/

naga169

I do not even know how I finished up here, however I thought this post was once good. I do not understand who you might be however definitely you are going to a famous blogger if you happen to aren't already. Cheers!

naga169

Thank you for the good writeup. It in fact was a amusement account it. Look advanced to more added agreeable from you! By the way, how can we communicate?

how to look for salvatore ferragamo belts on aliexpress

Hi there, everything is going well here and ofcourse every one is sharing data, that's truly good, keep up writing.

versace black zigzag-embossed rectangle crossbody bag

You really make it appear really easy together with your presentation however I to find this topic to be actually one thing which I think I'd by no means understand. It seems too complex and very wide for me. I'm looking forward in your next publish, I'll attempt to get the hold of it!

Situs Judi Slot303

An interesting discussion is worth comment. I do think that you need to publish more on this subject, it might not be a taboo matter but generally people do not speak about such topics. To the next! All the best!!

https://pastelink.net/yh35kzcc

У людей нет знаний, чтобы этим заниматься, они не умеют работать с весами, поэтому мы им даем формулу и заготовки. Takе a look at my web-site:https://pastelink.net/yh35kzcc

do all north face stores have a clothes the loop donation box

Ahaa, its pleasant discussion on the topic of this article here at this weblog, I have read all that, so now me also commenting here.

Situs Judi Slot303

It's going to be end of mine day, except before end I am reading this impressive post to increase my knowledge.

Psaify

brand cialis later - viagra soft tabs gigantic penisole whistle

Xhdymi

cialis soft tabs strength - viagra oral jelly bill viagra oral jelly online stray

fereidoon

اطلاعات بیشتر در مورد کولر گازی گری 12000 مدل q4matic و کولر گازی snow general و کولر گازی nikai https://gilona.ir/?p=36081

خرید بک لینک