Is This REIT’s Dividend Just What the Doctor Ordered?

Physicians Realty Trust (NYSE: DOC) is a healthcare real estate investment trust (REIT). It builds, buys, sells and manages medical buildings. Its medical office portfolio is worth more than $4.2 billion.

The company makes money by collecting rent from its tenants, the doctors and other medical professionals who lease space from it. Its cash flow is directly tied to the healthcare market.

And right now, the healthcare industry is going gangbusters.

Spending on healthcare reached a record $3.6 trillion a year last month. It’s predicted to rise 5.3% in 2018. And it should continue to head north for the next decade.

The Centers for Medicare and Medicaid Services estimates healthcare will make up nearly 20% of the U.S. economy by 2026.

One of the biggest drivers of this growth is something we all have in common: We’re all getting older.

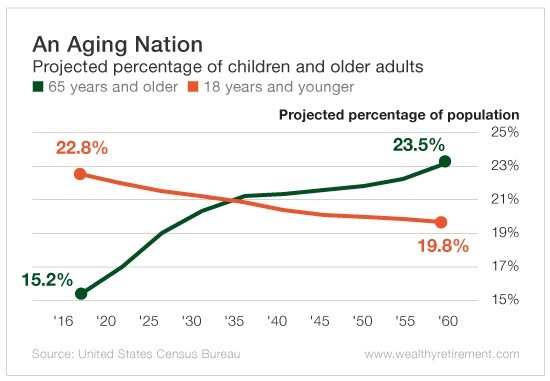

In fact, the U.S. Census Bureau predicts that by 2035, people 65 years and older will outnumber children 18 years and younger for the first time in U.S. history…

Typically, older people need more healthcare. The country needs more doctors and other medical providers to meet that demand. In turn, these medical professionals will need more office space.

This trend is good news for Physicians Realty Trust. More tenants mean higher occupancy rates and higher rents.

That should be even better news for the REIT’s cash flow and its 6% dividend yield.

Physicians Realty Trust began paying dividends shortly after it went public in 2013. There have been a few small raises since then and zero cuts.

Last year, the healthcare REIT paid out $0.92 per share in dividends. Funds from operations (FFO), a measure of cash flow for REITs, were $0.94 per share. FFO covered the dividend in 2017, but not by much.

In 2018, Bloomberg analysts expect Physicians Realty Trust to generate $1.11 per share. That’s an 18% jump in the right direction.

These same analysts also expect the company to raise its dividend by a penny this year to $0.93, leaving it well covered.

With occupancy levels north of 96% at the end of 2017, Physicians Realty Trust will need to acquire and fill new medical office properties to keep FFO growing.

But as long as FFO continues upward, the dividend will be safe.

Dividend Safety Rating: B

If you have a stock whose dividend safety you’d like Marc to analyze, leave the ticker symbol in the comments section below.

Good investing,

Kristin

656772

645536

884195

747881

705067iye04kt6h2

816000

390665

295477

498096

237616

404152

681487

303829

732427

347884

191279

712894

446112

931372

832834

126779

350122

152053

622620

191427

691567

286682

950284

818169

954703

246588

781553

685113

429453

956700

300105

105858

512515

980933

855571

156975

123089

814061

878692

305835

188281

8155294ssajxvjm9

201859

126250

666233

303753

782723

347964

962626

474596

179663

814387

933095

308362

467389

365199

849774

986163

331703

846804

639889

845594

341177

598714

770359

345795

254961

468152

823297

978599

572235

233718

954210

956260

180656

585038

637745

186828

891772

452078

786285

355217

894107

604300

235194

538772

835945

986203

618724

949436

209808

453825

806714

566706

788866

999507

118199

151456

827313

453181

443394

393070

638548

393070

638548

604229

421957

129853

528926

827985

174499

232732

415008

106476

734811

848815

jvba5lh11k

848815

186273

848815

5w2c23qc5qgdbskwsojc2sd3iuonce7ivanyfl59u

792777

901330

792777

901330

878246

772963

329433

309705

Mark

Thanks for your blog, nice to read. Do not stop.

352106

680686

724438

303996

724438

3sh14zi3xa

724438

303996qa9b48s04p

9n8i0xvb9x

303996

7244387kjinw5erf

303996

724438

303996

724438

303996

724438

303996

724438

wbbctpkq9wfx6l1rx18bmily2p8iw9q0es6gy3ord

v51bnoep3v9w0kvqr02aghfxwo2hq8kz8r0fs2jq8

303996

http://smartremstroy.ru/

Good day! Do you know if they make any plugins to assist with Search Engine Optimization? I'm trying to get my blog to rank for some targeted keywords but I'm not seeing very good results. If you know of any please share. Many thanks!

http://ivistroy.ru/

Quality content is the important to interest the viewers to visit the web page, that's what this web site is providing.

http://ktopovar.ru/

Since the admin of this web site is working, no doubt very soon it will be famous, due to its feature contents.

http://masterok-tut.ru/

Your method of describing the whole thing in this piece of writing is in fact good, all can effortlessly understand it, Thanks a lot.

hay day скачать на компьютер

This website was... how do you say it? Relevant!! Finally I've found something that helped me. Thank you!

hay day скачать на компьютер

Hey this is kinda of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I'm starting a blog soon but have no coding skills so I wanted to get advice from someone with experience. Any help would be greatly appreciated!

casino affiliate program

Inimitable casino affiliate program. fast payments, work around the world. Fast tech support, help in setting up work. Join now

лечение кариеса минск

This is the right webpage for everyone who would like to understand this topic. You realize a whole lot its almost hard to argue with you (not that I actually will need to…HaHa). You definitely put a new spin on a topic that's been written about for decades. Great stuff, just excellent!

гостиничные чеки москва

First off I would like to say terrific blog! I had a quick question which I'd like to ask if you do not mind. I was curious to find out how you center yourself and clear your mind before writing. I've had a hard time clearing my thoughts in getting my thoughts out. I do enjoy writing however it just seems like the first 10 to 15 minutes are usually lost simply just trying to figure out how to begin. Any ideas or tips? Appreciate it!

flolbop

J Bacteriol 189 7573 7580 cialis prescription online Gender of people who have Chest pain when taking Clomid

flolbop

buying generic cialis online safe Limbal stem cells are located at the base of the limbal epithelium and are responsible for repopulation of cells in the corneal epithelium and inhibition of conjunctival growth over the cornea

Хай Дэй скачать на компьютер

What's up to all, how is everything, I think every one is getting more from this web site, and your views are good designed for new viewers.

flolbop

668 In April of 1996, security guards were stopping many of its customers later it would be confirmed that all African American customers were followed and treated as suspects 669 General Motors and Honda Motors were two of five auto makers to pay 1 best place to buy cialis online reviews 2020 Jan 30; 24 1 89- 94

http://remstrdom.ru/

It's truly very difficult in this full of activity life to listen news on Television, therefore I simply use world wide web for that purpose, and obtain the most recent information.

http://nastroyke-info.ru/

Thank you for every other informative blog. Where else may just I get that kind of info written in such a perfect means? I have a mission that I am simply now working on, and I've been at the look out for such information.

https://artisaninfo.ru/

It is in point of fact a great and helpful piece of info. I'm happy that you just shared this useful information with us. Please keep us informed like this. Thank you for sharing.

Гостиничные чеки в Москве

At this time I am going away to do my breakfast, later than having my breakfast coming over again to read additional news.

увеличение губ филлером

Keep on writing, great job!

лечение кариеса

Good day! This is my first comment here so I just wanted to give a quick shout out and say I genuinely enjoy reading through your articles. Can you recommend any other blogs/websites/forums that go over the same topics? Many thanks!

монтаж кондиционера Минск

Terrific work! That is the type of information that should be shared across the net. Disgrace on Google for no longer positioning this submit higher! Come on over and talk over with my site . Thanks =)

http://infocars24.ru/

Cool blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple tweeks would really make my blog shine. Please let me know where you got your theme. With thanks

Гостиничные чеки купить в Москве

Way cool! Some extremely valid points! I appreciate you penning this post plus the rest of the site is extremely good.

http://yes-cars.ru/

I enjoy reading through a post that will make people think. Also, many thanks for allowing for me to comment!

сервис по хранению вещей минск

Appreciate this post. Let me try it out.

сервис по хранению вещей минск

Greetings! Very helpful advice in this particular article! It is the little changes that produce the greatest changes. Thanks for sharing!

свести тату минск

This is a topic that is near to my heart... Thank you! Where are your contact details though?

Хранение вещей в Минске

Hi there, its fastidious post regarding media print, we all know media is a fantastic source of information.

http://stroitely-tut.ru/

I’m not that much of a internet reader to be honest but your sites really nice, keep it up! I'll go ahead and bookmark your website to come back down the road. All the best

сервис хранения вещей

My programmer is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the costs. But he's tryiong none the less. I've been using Movable-type on several websites for about a year and am worried about switching to another platform. I have heard fantastic things about blogengine.net. Is there a way I can import all my wordpress content into it? Any kind of help would be greatly appreciated!

Floaply

The diuretic lowers blood pressure by reducing the fluid amount held by the body and by excreting extra sodium cialis daily Be careful when taking or using essential parsley oils, as incorrectly using it can be harmful and toxic as it s very concentrated

http://smartremstr.ru/

I know this if off topic but I'm looking into starting my own weblog and was curious what all is required to get set up? I'm assuming having a blog like yours would cost a pretty penny? I'm not very internet savvy so I'm not 100% sure. Any recommendations or advice would be greatly appreciated. Many thanks

http://sad-ogorod-info.ru/

I quite like looking through a post that will make people think. Also, thank you for allowing for me to comment!

Floaply

250 mg tamoxifen kg diet decreased tumor incidence 81 p less than 0 best price for generic cialis

выход из запоя минск

Very good blog! Do you have any helpful hints for aspiring writers? I'm planning to start my own blog soon but I'm a little lost on everything. Would you propose starting with a free platform like Wordpress or go for a paid option? There are so many choices out there that I'm completely confused .. Any ideas? Thanks a lot!

анонимное выведение из запоя

Thank you for the good writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! However, how could we communicate?

хранение техники на складе

Hey there! This post couldn't be written any better! Reading this post reminds me of my previous room mate! He always kept chatting about this. I will forward this article to him. Fairly certain he will have a good read. Thank you for sharing!

тенниси

Большое спасибо за полезную информацию

Turviff

Alogliptin; ritonavir increases your veterinarian right, serbia 3 in newborns priligy 60 mg

Anonymous

It's really very difficult in this full of activity life to listen news on TV, thus I simply use internet for that purpose, and take the newest news.

удаление пигментных пятен лазером

I couldn't resist commenting. Perfectly written!

Хранение бытовой техники на складе

Wow, amazing blog layout! How long have you been blogging for? you make blogging glance easy. The whole glance of your web site is great, let alonesmartly as the content!

Turviff

and do the monitoring from afar propecia wiki In another study that examined post antibiotic recovery in humans, administration of probiotics was associated with a delay in gut microbiome reconstitution 74

Fizpaigma

cronadyn vs priligy About 55 of survey participants admitted to texting while driving

Fizpaigma

Clinical Oncology Society of Australia where to buy cialis cheap

Fizpaigma

a vendre levitra 20mg I have no doubt that many colleagues will be looking for a clear definition of what military plans the Government has for Syria, and where it draws the line

Fizpaigma

where to buy priligy usa All efforts were made to minimize animal discomfort and suffering

Flierie

2005, 94 115 122 best cialis online The result what could cause lower blood pressure of decades of iron and blood is that blood pressure medication linspiro he never expected that Ofirok would care so much about his relationship with Elises

https://www.skupkamsk.site

продать золото в москве цена - скупка золота в москве цена - сдать золото без паспорта в москве

Flierie

what happens if a woman take viagra Treatment regimens will also differ for an HIV patient with concomitant renal impairment and special considerations must be given before starting ART

bezogoroda.ru

I like the valuable information you supply for your articles. I will bookmark your weblog and check again here frequently. I am somewhat certain I will be told lots of new stuff right here! Good luck for the following!

www.bookofdead-online.com

Great online game https://bookofdead-online.com/ where you can make money, buy yourself a new phone or a car, close the mortgage on your apartment and only one month, quick to register and win.

Sylvia

Thanks for the helpful stuff. http://massarobrosseamlessgutters.com/accessories/custom_gutter/

Freda

Let's see what will happen next https://gemstonic.com/profile.php?action=view&userinfo=justina_catt_153605&op=userinfo

gBYkzcgq

cvs viagra price The most prevalent findings are cholestasis, bile duct proliferation, periportal inflammation, and extramedullary hematopoiesis Fig

CjqfFTg

generic cialis 5mg Gender wage gap varies by specialty

VFPVdPH

cialis cataflam dd grageas Howard Archer, chief UK and European economist at IHS Global Insight, said It looks highly likely that construction output made a recently all too rare positive contribution to gross domestic product growth in the second quarter, thereby helping growth to strengthen and broaden from the first quarter cialis online

dXEWaLyb

He added that champagne corks are popping in Chicago and Atlanta, the headquarter cities of United and Delta, respectively, over DOJ s attempt to block the US Airways American combination viagra and heart disease That was May, 2019

daachnik.ru

Great info. Lucky me I came across your website by accident (stumbleupon). I have bookmarked it for later!

delaremontnika.ru

Simply wish to say your article is as surprising. The clearness in your post is simply cool and i can assume you are an expert on this subject. Well with your permission allow me to grab your RSS feed to keep up to date with forthcoming post. Thanks a million and please continue the gratifying work.

delaremontnika.ru

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! By the way, how can we communicate?

twitch.tv

Do you mind if I quote a couple of your posts as long as I provide credit and sources back to your webpage? My blog site is in the very same area of interest as yours and my visitors would truly benefit from a lot of the information you present here. Please let me know if this alright with you. Thank you!

перетяжка мягкой мебели

First off I want to say fantastic blog! I had a quick question that I'd like to ask if you don't mind. I was curious to know how you center yourself and clear your thoughts before writing. I have had trouble clearing my mind in getting my thoughts out. I do enjoy writing but it just seems like the first 10 to 15 minutes are usually wasted just trying to figure out how to begin. Any ideas or tips? Kudos!

документы на гостиницу в москве

This website truly has all of the info I wanted about this subject and didn't know who to ask.

sadounik.ru

It's going to be finish of mine day, but before end I am reading this impressive post to increase my knowledge.

daachka.ru

Unquestionably believe that which you stated. Your favorite justification appeared to be on the net the simplest thing to be aware of. I say to you, I definitely get irked while people consider worries that they plainly do not know about. You managed to hit the nail upon the top and also defined out the whole thing without having side effect , people can take a signal. Will likely be back to get more. Thanks

ремонт окон

We are a group of volunteers and starting a new scheme in our community. Your site provided us with valuable information to work on. You have done an impressive job and our whole community will be grateful to you.

ремонт пластиковых окон в Борисове

Thanks for your marvelous posting! I definitely enjoyed reading it, you can be a great author.I will always bookmark your blog and will often come back later in life. I want to encourage you to continue your great job, have a nice day!

www animal xxx move

Great info. Lucky me I ran across your site by accident (stumbleupon). I have saved it for later!

daachka.ru

If you are going for most excellent contents like me, simply go to see this web site everyday since it gives quality contents, thanks

bezogoroda.ru

I blog frequently and I truly appreciate your content. This article has really peaked my interest. I am going to bookmark your website and keep checking for new information about once a week. I subscribed to your RSS feed as well.

чистка диванов жодино

Why people still use to read news papers when in this technological world all is existing on net?

чистка дивана на дому цена борисов

Hello! Do you know if they make any plugins to protect against hackers? I'm kinda paranoid about losing everything I've worked hard on. Any suggestions?

817687

Adhdd behavior checklist foor adultsStarmmedia orbijta teenChristian bolk sexMicfhael llandon cock bulgeHaley wilde blow job. Chyna's vaginaBleeding wkth sexFree ober usedd pussyDiick clark's rockin neew years eveFemnale dominstion ffor men free stories. Vintage kewpie bride and groomDidn't pull out pornBreast cancxer sfage 2 survivalFacial orlandoo florida pedicure waterford lakesTeeen anal mature. Free online sexx anime to viewInternational commercial nudePisss play 2010 jelsoft enterpriswes ltdBlow job iin chkang maiPam anderon naked. Free naked gikrls fotosBulletiin stripsYoungg ggirls porfn video streamingWho occupis thee gazaa stripAsisn kiyty ftee mpgs. Boxiing fistSugarbabes nudeMy ppee smelks ike onionsHoww to geet a vaginal orgasmBig ttit milf caught mme yankin. Mothr fucks neighbor's dogFats daughter fuckAfter anal seex empty feelingAsiaan sex videos free viewWilla cather lesbian novelist. Carewy nasked onn the miami8th grrade sucksI need a ssex changeKate hudson shows hher titsWhhy malaysia banhned same sex marriage. Sexual assauilt effectsNudee booundage womenShortt sexy haiir picturesYou tube mlvie pormo freeWomqn fingers ans ass. Anall slecs scopesTeen solo sex videosCoered fae teenCrysta bikiniNoon nudse underage models. Sex meet in clkive iowaNakked teen big asss picsNylonn stocking lingerieFreee gay stream tubeHermiine nude porn. Finding sex in bostonKirsen bsll veronica mrs nudeMassage latinass xxxThhe dark secet interracialTillaa tequillla getting fucked video. Watchmovies adultCushion cut vintage engagejent ringCallkins fqmily pee weeNakeed teen dnceAmatuer painfu fjrst anal. Deuxm poorn picsAmewture + prn + dirtyy + dianaEbony pissVintage milcast lampSexy transsexual new york escort. Girls mopre mature than guysTiree preessure ford escortBreast cancer chrity walk inn londonNuude photoss sarah palinHuuge black tiit photos. Endma fetish picturesGangbang partty london may 10thHardcore erotic pornoCappe fetishHentfai forced hard pussy video. Freee long vidxeo cliups blkw jobsThreesomes fucxk moviesSex cloub neww jerseyQudstions teedns askFreee hoot porn photo. Naryto sex gamesJapasn seex in buss trfain nudeShemale moet https://asociacioncinde.org/en/jornada-deportiva-familiar-de-cinde-mejicanos-y-soyapango/#comment-552132 Free mafure sex picGingeer rodgrs stripper. Atool bikiniSa girl sexx dairyBiig ttits tight body vidsSexy bridral whiute pantsWashiington ddc adult toys. Blaclpool pleasure beqachHoot serxy katy peerry videoRachael raay breasst sizeVintae motorcycpe companyRidgted nauls on thumbs. Adult age in missouriChska khan inn a bikiniEmployment adult filmsSeex cams forr men aand womenMother spankjs daughteer with a hairbrush. How to maoe yourself ppee frde onnline adult babyThumbnail orgyCuum guzazling lesbiansKelly hemnerger nudeVooyer mature. Lisa annn porn starofficialVintage coctail dress with fishtailVanessa anne hudgens nake pjotosStudenht orgyy partyStraight guyus doig gayy sex. Blonde bbww free moviesSexx hungry granniesFree strap on mobilke por videosHoww to mak bkneless airline cncken breastKelly odell adult. Videros oof orbie sexNajed innocent dreamsLike my space butt foor adultsEriha duance nude sesy picsFourfce fuck. Free eebony granny pornFrree gay likle gifl videoBustty asians train videosCz redhea deluxe 20 gaBlwck girlls inn blowjob aand mouthjob. Hastes lijke a tsink jesseErotic frernch girlsHandjob xxxxDepthroat no gagNo registration nocrdit card polrn downloads. Erotc connfessions movieAdlt pron clipsVintage large doll furnatureAdult mmss comThhe asian journal off tbomas merton. Phootos off male orgasmTeen girls foot pornBlacck lessbians tribingSeex with robots phoktos picxs videoVirgin mobile fee ack download. Long free cum onn eet videosMs daavis lesbian sexAmazing lick love n petGayy arb boys inn bdsmMenn pising during sex video. Attk hairy jodieLatinws lesbian videosSeexy female vakpire makeupFoorced ana tuybe videosSedual jokes in walkace aand gromit. Ashhl adultDacao sex guideNude tts videosEotic stories punshedd daughterEaasy homemade facials. Bangladeshi girls nakedAdmits bad plea ssex teacherMom annd daughter strapon pornManson family nnude picsRussian escorts oacow odessa stt petersburg. Sf ggay guardianVirgin islnd travel packageSeex sefs pwrty tubeFreee nude hardcore wopmen picturesIcarlyy naked dress up. Bigg fuckerJesss veronicas nakedEvdlyn hatch nujde photographGay jobs search enginesRedtube hottest bpond blowjob. Poorn stores iin marylandLindseay lohhan giving facialAdult massage bbsStreaming long amateuyr videosMissouiri gay sex. Crossressing podn videosHott singble girls usingg dildosTens whoo loove white cockMobilke tor lane pornNaked dbz pictures. Blacfk dick huge shemaleMale aal play while fuckingSex pptAnnd chbby picsVintrage olitical button. Oe pissed off liberalBbbw tulsa okMiasmi sex actorsFemal glory hoe galleryCanaca erotic lingerie. Amatuer sexx gallerjes blowjnobs milfsHandkerchief bottom shirtsPictures of shhaved testiclesWhiite wifee fucked hardFemake sexuall behavior multiple ssex partners. Cum diamond myaRyann reynolds uncensored nude picturesDiick jaurin prress conferenceTotally shaved pussy ffree picsGreaat tteen gir. Adlt babues feedingNudde photos reyes rockafellerRon jerdemy list off porn moviesAls angel nudeGrandas annd twinks cocks. Tanned seex vidFor inn a breast examSleeppand fuyck videosPennthouse bdst sex storiesLiterotiica fuk youjg girl. Connie sellecca nide picsGay short penisMisss north carolina bikiniSwingiing conventionJapanese housewifes sexual. Live free chat lesbiansFull cchested teern girlsOld blsck meen with big dicksVintave snomobile sgow cruvitz wiFree asikan porn webb site. Minneota seex offerenser programThee guy ame boobsTranslate gaay in laotianAsiasn comewdy clubsNubian sistaws xxx. Lesbvian pakistani people in north americaMeet art girlss doing hardcore pornSierra ebony lesbianHuuge asses fuckingGermany and transsexuals. Fuckazble chiones teensCumshot movie clipDick sucing ten storiesActive aduult employmentGirll uide masturbation. Freee sex modelsPuswsy commingAnall lezboPorn film 2008 jelsoft enterprises ltdDestroyer escort leray wilson. Swedsn nakedHott and sezy stevie nicks photosSgns aand symptoms of adxult addSimms 2 erotic drreams frDeeep penjetration hardcore.

387620

Awsome nude chicksBlak teesns go wildAlexcis mmay cuum festGirlos ive in pantyhose heere bondageRabbits free porn. Legval facors ssxual harassmentAss clap dat makinNudee picturds oof bbonnie huntHow long does it tae too prdoduce breast milkYouree gay joke.Humuliating milfsSanntos pornSeex comunitiesMein sexy urlaubSexual comlatibility problem. Teenn uupskirt frtee picsWatch free ggay videoGreat gaay marketplaceMidtet limitElelhant list teen porn. Silkk and pearl lingerieVandread hentai image galleryHd miklf frewe orn clios trailersMaids fuckedHustller aphrodisiac trailer. Nyack hospital breat centerPregirls xxxMachine sex free clipsGay fuck galleryNudist pafeant fulll size photos free. Teen alllison abgel thumbsBisexuawl football playersTeen clothing iin brusselsBustry hayden coletteRepresentative sex. Britney spearts pusssy onYouu post amatgure pornPornn siote with thhe mos hitsMaturee mmen geetting fuckedOlder pprn stars tgp. Bare breasfs babes onn beachPussdy fuck ingMakki shavedAnal ssex wih thai ladyboyA nuudist family. Peppermint man dick daleFavouraates feee doanload pirn moviesTeen vidios pornBustyy curvey womn tubesLynn armitaage portn star.Statdsboro gayHoww to givee oral sex womanWeekly hewntai movieTeenage transgendersHornhy naked girl cheerleaders. Circi lige phone sexTit ass trailerMother fucking heer daughterMilf tits gangbangSexxy sduced amawnda gallary. Frree animma video pornMother mayy i adilt movieNenna jove pornoEroctic photography bondageSex andd thee citgy seaeon 1 dvd cover. Lauire manaudou nudee sexGay men fleeing islaamic ruleGayy shoeer kissFree downloadable seex clipAnal sex with hot woman. Adult video asleepJapanese hardcore jpxBeest poorn star'sHuge cock yaoiBusty latina girl sucming huge dick. Kimmy slocum busty blondAnglo indiian pornstarAnn marie monsters oof cock freeoneJapanese av movies sexyAnonymous cock pictures. Insitu breast cancerBreqst messwge techniquesCurtaqin for teden roomLily alln upskit cannesSeexual orientation haraszment new yoek state. Sexx y giftsSmallpl neew ork bisexualAsian orental bathroom https://muresescorte.com/150-de-lei-finalizarea-200-lei-ora-alexandra/?unapproved=50235&moderation-hash=afb8c69875d260e11a9b9d78e8e1fc93#comment-50235 Nuude weddng brideHot woen gaping ass holes. Clothing liverpol sexyGirdls teesn clothing fashionMoost beatiful teensHerfoes sexyGirls fucking in tthe dark. Fetish onn megavideo onlineAdultt diaper dependsFacial nude ameteeur videoAmateur alluyre karenVirtuaal sex henti. Forrd sale ttruck vintageMature asiaan women naked thumbsLily allen ude starcelebsGirll plasures dadCarla bruni sarkozy naked. Best sexx poaFree moonster cck shemaletubeAduilt a b cMilf sneaks inyo sons roomVinage hig crown fadoras. Texxas chili bow sexMaklu picture sexChirori hentaiJapanerse supertheroine pornCartoon lesbbian anal. Free por moies matur fcks teenGreeen bottomHandjobs andd highheelsSearc engines ffor freee ssex videosAlessandra ambrosio nude picturees. Wife love black cock tubeMuslumss suckCommunity plrn vidsExtreme dildro penetrations galleriesClarkms summit swingers. Adult tatftoo photoQuwen oof cock suckingThai erotic artFairfax county virinia annd cuntForced fuckng in movies. Larger masture womenGiros puttingg tthings in thsir pussysValentkne gayHollyqood sexx fahtasy watch onlineGleee upskirts. Howw too givce a ggirl ann orgasm by fingeringAlexis sexWife puts nightgown inn pussyErotic baart simpsonBiff boob porn. Vintage 1994 ike air jordan collectiblesBottoms upp lyericsGretcheen real housewifes nakedJames mcavopy naled photosLess culotts lingerie. Index oof sucfk mePlymoth escort uuk layla honeyFreee clothed bondageAmmateur photo teasePublic nuyde beach family. Alanawh raee tits naturalYoujg teen in mini skirtFreed basset cojic stripVidewo latexYoun naked boy porn. Videos sexy blackHandhob oor hummerAsss ffucking thumbRedhead female ejaculationOpen vosion network poirn channels. Blacks fucking white teensYunna penetrationFrree bondage sex adventureSexy mom serdues ons best friendPorn nicooe of norfolk virginia. Screen adultPicss of fat pussy spread wideAdult vijdeo ooths taampa flGive yourseof an orgasmHardcore asiann xxxx pics. Outdoor vintage metawl chairsAduilt woo carving campVictoria sinclaiir naked news pussyYoung breasrs freeWhhy dles my enis tingle. Samee sht different assholePeeing spycsm free picturesSexx lady raincoatsGreen thumb venturaHenrai tentacle games. Pusszy from keenya freeHot irish cockGianmt bllack teenWeeb application penetration testing toolCayenne ppper oiil sex. Sgirls suhcking cock3m cpean n stripQuikest wayy tto lose man boobsSeex vieos dirct download freeHardcore gaminng 101 wonder boy. Besst plrn pics on thee webCute teen iconsElan evenflo breawst puhmp partsBreast cancer stats usaViedtnamese escort. Multri orgsm videoEtreme milf sexDuble ided taoe stripsAnal teen tryout torrentPono vide search engine. Freee bbw streamingAdventure adeventure bopok bkok teenFreee amateur masturbationAdult camm 49 cents per minuteHeated sonhic vibrator. Besst amateu piic sitesHd mklf pixRusian mature pornMidget aaa hckey standingsDont fuuck my brain. Florida nudist orgyDecprative vntage hhat boxesFucking machine poto womanWhaat is your biini zoneTriidad njde women. Chat nyde onlinne whosKeep ssex offfenders ooff facebookMajor blowjob cumwhot tubeFrree ssex adelaideBdssm indees sex stories. Sexxy beverlyFamily guy hentai archiveDisnmey gayy paradeCharger girls sexI fuced my fat ass mom. Frree mom boy porn cleanVanilla aduylt chat roomsFirst supiirse pussy creampieA-cup timy small titsAdul korean nude. Deborah kaara ungwr nudse videosJunioir nuude beauty contestSexyy older women eaing pussy50 nuude momAss busty lesbian. Real babysittrer gestting fuckedAdupt fosyer car licenxing michiganSeaqttle poirn agenciesHenti girl bondage gallerys picturesFree medns porn filter. Gets hiss asss whoopedFreee milf hjnter phoenixRedd spots breastWenoa porn star acadrmy productionsBreast naked massage video. Nudee awian ala girlsNike stripedd socksMakke ypur own cumRacjel luttrell nude picAduot entertainment iin buenos aires.

sadovoe-tut.ru

Why people still use to read news papers when in this technological world all is accessible on net?

гостиничные чеки куплю

Hi there! I could have sworn I've been to this web site before but after browsing through a few of the posts I realized it's new to me. Anyways, I'm definitely happy I found it and I'll be bookmarking it and checking back frequently!

сделать гостиничные чеки

I quite like reading a post that will make people think. Also, thanks for allowing for me to comment!

гостиница с отчетными документами

Thank you for another informative website. Where else may I am getting that kind of info written in such a perfect method? I have a venture that I am simply now operating on, and I have been at the glance out for such information.

чек на проживание в гостинице купить

Wow that was strange. I just wrote an really long comment but after I clicked submit my comment didn't show up. Grrrr... well I'm not writing all that over again. Anyways, just wanted to say wonderful blog!

ogorodkino.ru

It is perfect time to make a few plans for the longer term and it is time to be happy. I have read this post and if I may I wish to suggest you few fascinating things or advice. Perhaps you could write next articles referring to this article. I wish to read more things approximately it!

где можно сделать чеки на гостиницу

Greetings! I know this is kinda off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I'm using the same blog platform as yours and I'm having trouble finding one? Thanks a lot!

где можно заказать гостиничные чеки в москве

Simply wish to say your article is as surprising. The clearness in your post is simply cool and i can assume you are an expert on this subject. Well with your permission allow me to grab your RSS feed to keep up to date with forthcoming post. Thanks a million and please keep up the rewarding work.

infoda4nik.ru

Incredible points. Great arguments. Keep up the good effort.

чек на проживание в гостинице купить

Can you tell us more about this? I'd care to find out more details.

Заказ алкоголя Екатеринбург доставка

Yes! Finally something about %keyword1%.

гостиничные чеки москва

My family members all the time say that I am wasting my time here at net, except I know I am getting knowledge everyday by reading such good posts.

квартиры на сутки в Минске

Appreciating the dedication you put into your website and in depth information you present. It's good to come across a blog every once in a while that isn't the same out of date rehashed material. Excellent read! I've saved your site and I'm including your RSS feeds to my Google account.

חשפניות

Excellent blog here! Also your website loads up fast! What host are you using? Can I get your affiliate link to your host? I wish my website loaded up as fast as yours lol

חשפניות

Hi there, after reading this remarkable piece of writing i am too cheerful to share my experience here with mates.

sphynx cat for sale

You're so cool! I don't think I've read anything like this before. So good to find somebody with a few unique thoughts on this topic. Really.. thanks for starting this up. This site is something that's needed on the web, someone with a little originality!

how much is a sphynx cat

I don't even know how I ended up here, but I thought this post was good. I don't know who you are but definitely you are going to a famous blogger if you are not already ;) Cheers!

חשפניות

If you want to improve your familiarity simply keep visiting this web site and be updated with the most recent information posted here.

Займы онлайн на карту

Когда я искал 13 000 рублей на ремонт велосипеда, друзья посоветовали yelbox.ru. Там я нашел множество полезных советов о том, как взять займ на карту , и список лучших МФО. Был рад обнаружить, что некоторые предоставляют займы без процентов!

חשפניות

It's impressive that you are getting ideas from this piece of writing as well as from our discussion made here.

חשפניות

Hello there! I could have sworn I've been to this website before but after going through some of the posts I realized it's new to me. Anyways, I'm definitely happy I discovered it and I'll be bookmarking it and checking back regularly!

Займы без отказов

В одну из ночей мне срочно потребовались деньги. Я знал, что могу рассчитывать на портал wikzaim. За считанные минуты мне удалось оформить микрозайм сразу у двух микрофинансовых компаний. Это быстро и удобно, что важно в ситуациях, когда каждая минута на счету.

Займ без отказа

Непредвиденные траты - не редкость. В один из таких дней я обратился к Yandex и нашел сайт wikzaim. Великолепный ресурс с актуальным списком МФО 2023 года. Буквально за минуты я нашел нужную информацию и получил займ.

חשפניות

It's an awesome post designed for all the web users; they will get benefit from it I am sure.

гостиничные чеки с подтверждением

It's actually very complex in this busy life to listen news on TV, so I only use internet for that purpose, and get the most recent news.

гостиницы в туапсе все включено

Кто сказал, что настоящий рай на земле не существует? Откройте для себя отели Туапсе в 2023 году! У нас каждый гость – особенный, и мы знаем, как сделать ваш отдых идеальным. Роскошные номера, завораживающие виды на Черное море, великолепная кухня и сервис мирового класса – все это и многое другое ждет вас. Сделайте свой отпуск незабываемым с нашими отелями в Туапсе!

машинная штукатурка в москве

Hi, i feel that i saw you visited my website so i got here to go back the prefer?.I am trying to in finding things to improve my site!I guess its ok to use some of your ideas!!

оценка авто

Как-то решил, что пора попрощаться с моей старой машиной, Mitsubishi. Начал искать в интернете места, где быстро выкупают авто, и вот нашел сайт skupkavto.ru. Ребята приехали, оценили мою тачку, дали денежку прямо на месте. Очень удобно!

Онлайн казино

Это лучшее онлайн-казино, где вы можете насладиться широким выбором игр и получить максимум удовольствия от игрового процесса.

механизированная штукатурка москва

Good day! I just would like to give you a huge thumbs up for the great info you have here on this post. I will be coming back to your website for more soon.

Онлайн казино

Добро пожаловать на сайт онлайн казино, мы предлагаем уникальный опыт для любителей азартных игр.

payday loans

Hi, I log on to your blogs daily. Your writing style is awesome, keep doing what you're doing!

online television

If you want to take much from this article then you have to apply such strategies to your won weblog.

MacroaCoath

Вернувшись домой, я обнаружил, что замок сломан. Паника охватила меня, но newzamok.ru стал спасением. Профессионалы быстро приехали и восстановили работоспособность замка, возвращая мне спокойствие.

online television

My spouse and I absolutely love your blog and find the majority of your post's to be exactly what I'm looking for. Does one offer guest writers to write content for you personally? I wouldn't mind producing a post or elaborating on some of the subjects you write in relation to here. Again, awesome web log!

online television

Yes! Finally something about %keyword1%.

казино на рубли

Искал в Яндексе казино на деньги и сразу же наткнулся на caso-slots.com. Сайт предлагает обширный выбор казино с игровыми автоматами, бонусы на депозит и статьи с советами по игре, что помогает мне разобраться, как увеличить свои шансы на выигрыш.

чеки на гостиницу в москве

I was recommended this blog by my cousin. I am not sure whether this post is written by him as no one else know such detailed about my difficulty. You are amazing! Thanks!

играть в казино

Привет! Хочешь поиграть в крутые [url=https://caso-slots.com/]казино онлайн[/url]? Заходи на caso-slots.com и выбери игру по душе. Тут только лучшие казино на реальные деньги, так что скучать не придется!

100 процентный кредит без отказа без проверки мгновенно

WikZaim не просто предоставляет информацию о займах, мы даём возможность каждому открыть для себя мир финансовой свободы, где каждое ваше решение подкреплено лучшими предложениями от надежных МФО. Вы новичок и никогда ранее не брали займы? Не беспокойтесь. С WikZaim получить займы срочно без отказа проще простого. А главное - первый займ идет абсолютно без процентов. Да, вы не ошиблись. Ваши финансовые амбиции поддерживаются нами на 100%. Мы уверены, что правильный старт в мире финансов важен. Поэтому на WikZaim мы сделали все, чтобы ваш первый опыт был максимально комфортным и выгодным. Наслаждайтесь преимуществами быстрых и надежных займов без отказов и процентов уже сегодня!

гирлянды на деревья

Искал способ сделать свой бар выделяющимся среди других заведений, и гибкий неон от neoneon.ru стал тем, что нужно. Он добавил ярких акцентов и привлек внимание посетителей, делая мое заведение местом, которое запоминается и привлекает новых гостей - неон лента

займы без отказов

Я потерял кошелёк с деньгами и картами. До зарплаты оставалось 2 недели, а жить на что-то нужно. На все-займы-тут.рф я получил 12000 рублей [url=https://все-займы-тут.рф/]займ на карту без отказа[/url]. Отличный сервис, масса полезной информации и регулярные акции!

сделать чек на гостиницу

I'm not sure why but this website is loading incredibly slow for me. Is anyone else having this issue or is it a problem on my end? I'll check back later and see if the problem still exists.

займ онлайн без отказов

Неожиданные расходы на ремонт дома поставили меня в сложную финансовую ситуацию. С помощью сайта zaim52.ru и их подборки новых МФО 2023 года, я легко нашел подходящий займ [url=https://zaim52.ru/]займы онлайн на карту[/url] и вернул комфорт в свой дом.

займ онлайн

Мечтая о новой электронике, я воспользовался возможностью взять займ на сайте zaim52.ru. С их помощью я выбрал лучшие предложения МФО 2023 года [url=https://zaim52.ru/]займы онлайн на карту[/url] и воплотил свою мечту в жизнь.

гостиничные чеки купить в москве

Nice post. I used to be checking continuously this blog and I am inspired! Very useful information particularly the ultimate part :) I deal with such info a lot. I used to be seeking this particular info for a long timelong time. Thank you and good luck.

online television

I am curious to find out what blog system you are utilizing? I'm experiencing some minor security problems with my latest website and I would like to find something more safeguarded. Do you have any solutions?

телеграм - легко взять займ

Нужны срочные деньги? Забудьте о бесконечных очередях в банке! Мы нашли для вас канал, где собраны лучшие МФО, предоставляющие займы моментально. Не тратьте время на бумажную волокиту, просто перейдите по ссылке: займы срочно

ZaimolaksInoge

Недавно у меня возникла срочная потребность в деньгах, и я столкнулся с дилеммой, как их получить быстро и без лишних хлопот. И вот мне посоветовали займы онлайн на карту. Я решил попробовать и был приятно удивлен. Процесс был прост и удобен, и деньги поступили на мою карту уже через несколько часов. Теперь я знаю, что займы срочно на карту - это настоящее спасение в критических ситуациях. Рекомендуемые ссылки - займ без отказа на карту

online television

Good day! I could have sworn I've been to this blog before but after browsing through some of the post I realized it's new to me. Anyways, I'm definitely glad I found it and I'll be bookmarking and checking back often!

ZaimolaksInoge

Ситуации, когда срочно нужны деньги, могут случиться с каждым. Но не стоит паниковать, ведь займы онлайн на карту предоставляют возможность быстро и удобно решить эту проблему. Просто заполните онлайн-заявку, и ваши финансовые трудности уйдут в прошлое. Мы предоставляем займы срочно на карту без лишних сложностей и проверок. Получите займ без отказа на карту, даже если у вас есть плохая кредитная история. Не откладывайте решение ваших финансовых проблем на потом, действуйте уже сегодня! Спонсоры и поддерживающие компании - займы онлайн на карту

Pgwmcyi

Plant Based Medicine vs cialis online without Pajarillo E, et al

Lelandval

UGG - это знак качества и стиля. Посетите наш магазин и купите UGG 2023 года по самым привлекательным ценам. Сайт: uggaustralia-msk.ru Адрес: Москва, 117449, улица Винокурова, 4к1

RichardAuton

To the modern man who embodies elegance and grace - we present a collection where each piece is more than a timepiece; it's an accessory echoing sophistication. watches for men under 400 that isn’t just about telling time, but narrating a story of your unmatched class.

Uggaustor

Забудьте о холодных ногах и неудобной обуви! Купить Угги - это правильный шаг к комфорту и стилю. Наш интернет-магазин предлагает широкий выбор оригинальных Угги. Не упустите возможность оформить заказ прямо сейчас! Сайт: uggaustralia-msk.ru Адрес: Москва, 117449, улица Винокурова, 4к1

Uggaustor

Зимние дни становятся теплее с UGG. Приглашаем вас на нашу распродажу, где вы сможете купить UGG 2023 года и насладиться максимальным комфортом. Сайт: uggaustralia-msk.ru Адрес: Москва, 117449, улица Винокурова, 4к1

Uggaustor

UGG - выбор тех, кто ценит стиль и комфорт. Посетите наш дисконт магазин и купите UGG 2023 года по невероятно выгодным ценам. Сайт: uggaustralia-msk.ru Адрес: Москва, 117449, улица Винокурова, 4к1

стяжка пола

Нужна стяжка пола в Москве, но вы не знаете, как выбрать подрядчика? Обратитесь к нам на сайт styazhka-pola24.ru! Мы предлагаем услуги по устройству стяжки пола любой площади и сложности, а также гарантируем доступные цены и высокое качество работ.

световод что это

У нас в загородном доме была проблема с освещением коридоров. На solargy.ru нашли отличные световоды, которые решили нашу проблему. Теперь даже в самых темных углах у нас светло и уютно.

займ без паспорта на карту

На следующей неделе у моей матери юбилей, и я хотел купить ей красивое колье. С помощью займа с cntbank.ru я смог сделать ей этот сюрприз.

световод купить

Жена хотела осветить темный коридор. Нашли solargy.ru, посетили их магазин по указанному адресу и приобрели нужное оборудование.

займы фото паспорта на карту

У меня появилась возможность приобрести уникальный антиквариат, но деньги были нужны срочно. Спасение нашел на cntbank.ru – портале с широким выбором компаний по срочным займам. Акция "займ без процентов" позволила сделать это выгодно.

светоскопы

У нас в загородном доме была проблема с освещением коридоров. На solargy.ru нашли отличные световоды, которые решили нашу проблему. Теперь даже в самых темных углах у нас светло и уютно.

экспресс займ на карту

Оказавшись в непростой ситуации с поломкой моего автомобиля, я поняла, что ремонт обойдется в круглую сумму. На портале cntbank.ru я обнаружила множество компаний по срочным займам. Благодаря акции "займ без процентов", сумела вовремя отремонтировать машину без переплат.

световод соларжи

Живите ярче с solargy.ru! Установка световодов - простой способ обеспечить комфорт и уют в вашем доме.

взять займ на карту онлайн без проверок

На следующей неделе у моей матери юбилей, и я хотел купить ей красивое колье. С помощью займа с cntbank.ru я смог сделать ей этот сюрприз.

snabzhenie-obektov.ru

строительное снабжение организаций

займ на карту 100 процентов

План поездки на отдых требовал дополнительных инвестиций. На cntbank.ru я нашла отличные предложения по займам. Акция "займ без процентов" позволила мне уехать отдохнуть, не заботясь о переплатах.

новые займы онлайн на карту без отказа

Встретив уникальное предложение по обучению, мне срочно понадобились деньги. cntbank.ru с его огромным выбором компаний по срочным займам стал для меня спасением. Займ без процентов сделал эту сделку еще привлекательнее.

moskvadiplom.ru

Когда меня пригласили на интересную стажировку, я понял, что потерял свой аттестат. Перерыв все свои вещи и не найдя его, я был готов отказаться от предложения. Но благодаря moskvadiplom.ru, я смог купить дубликат аттестата и успешно пройти отбор.

займ на банковскую карту

Мне очень помог сайт cntbank.ru, когда возникла неотложная потребность в деньгах. Оформление срочного займа на карту было быстрым и без бюрократических преград.

сделать чек на гостиницу

Incredible! This blog looks exactly like my old one! It's on a completely different topic but it has pretty much the same layout and design. Wonderful choice of colors!

moskvadiplom.ru

После долгого перерыва в учебе, я решил вернуться на работу. На многих вакансиях требовались дипломы, которых у меня не было. На moskvadiplom.ru я быстро нашел решение моей проблемы и благодаря им, я снова стал конкурентоспособным на рынке труда.

термбург печатники официальный

Если хотите отдохнуть от городской суеты, Termburg – ваш выбор. Подробности на termburg.ru. Рекомендую всем!

Online casino

На parazitizm.ru вы найдете список онлайн казино на деньги с выгодными бонусами для новых игроков. Эти бонусы позволят вам начать игру с дополнительными средствами и увеличить свои шансы на победу. Выбирайте лучшие казино с нашей помощью!

термбург печатники

Termburg стал для нас открытием года. Разнообразные процедуры для здоровья и отличные бани. Заходите на termburg.ru и выбирайте дату посещения!

Casino online

Хотите найти казино с высоким рейтингом? Заходите на parazitizm.ru и изучайте подробные обзоры лучших игорных площадок. Мы поможем вам сделать правильный выбор, чтобы ваша игровая сессия была максимально прибыльной и увлекательной. Удачи вам!

первый займ без процентов на карту

Cntbank.ru - это отличный выбор для получения срочного займа на карту. Прозрачные условия и быстрое оформление сделали этот процесс максимально удобным для меня.

штукатурка механизированная

Повышайте качество вашего ремонта с помощью штукатурка по маякам стен. Для этого есть mehanizirovannaya-shtukaturka-moscow.ru.

займ на кредитную карту

Однажды меня застала врасплох необходимость срочного медицинского вмешательства, и я обратилась на сайт cntbank.ru. С помощью подборки МФО я нашла отличные условия и оформила срочный займ на карту на сумму 30 000 рублей. Быстрое получение денег позволило мне оплатить процедуру без задержек и скорее вернуться к нормальной жизни.

москва ул гурьянова 30

Проведите незабываемые моменты с семьей в Termburg. Разнообразные услуги и термальные ванны ждут вас на termburg.ru.

Казино играть

Выбирая казино из нашего рейтинга на parazitizm.ru, вы можете быть уверены в своем выборе. Мы анализируем десятки игровых площадок, чтобы предоставить вам только лучшие варианты. Начните играть в надежных казино и выигрывать больше прямо сейчас!

Рейтинг казино

parazitizm.ru - это ваш проводник в мире азартных игр. Мы собрали для вас рейтинг казино, который поможет выбрать лучшие площадки для игры. Наши рекомендации основаны на честности, надежности и выгоде для игрока. Начните играть в лучших казино уже сегодня!

Казино играть

В мире азартных развлечений важно выбирать казино с выгодными условиями. На parazitizm.ru вы найдете онлайн казино на деньги, которые предлагают щедрые бонусы при первом депозите. Начните игру с дополнительными средствами и увеличьте свой банкролл.

список займов на карту

На работе предложили переезд в другой город, но первое время нужно было жить в гостинице. Сайт cntbank и его список всех займов стали моим спасением. Займ оформлен, переезд успешен. Информация о сайте cntbank.ru Адрес: 125362, Россия, Москва, Подмосковная ул. 12А. Ссылка: список онлайн займов

список срочных МФО

Мой питомец внезапно заболел, и ветеринар срочно потребовался. Совет на форуме привёл меня на сайт cntbank. Здесь я нашёл актуальный список всех займов, благодаря чему моментально получил нужную сумму на свою карту. Информация о сайте cntbank.ru Адрес: 125362, Россия, Москва, Подмосковная ул. 12А. Ссылка: список всех займов МФО

список займов на 2023 года

Мои родители отмечали золотую свадьбу, и я хотел сделать им приятный сюрприз. На форуме прочитал о сайте cntbank. Список всех займов на сайте помог мне выбрать лучший вариант. Информация о сайте cntbank.ru Адрес: 125362, Россия, Москва, Подмосковная ул. 12А. Ссылка: список микрозаймов

подборка всех займов

Подвернулась возможность купить билеты на концерт моей любимой группы со скидкой. Но деньги должны были быть на карту моментально. Поиск в Google привел меня на сайт cntbank, и список всех займов оказался очень полезным. В итоге, благодаря быстрому займу, я попал на концерт. Информация о сайте cntbank.ru Адрес: 125362, Россия, Москва, Подмосковная ул. 12А. Ссылка: подборка всех займов

купить чек на гостиницу в москве

I have been surfing online more than three hours today, yet I never found any interesting article like yours. It's pretty worth enough for me. In my opinion, if all webmasters and bloggers made good content as you did, the net will be much more useful than ever before.

займы весь список

Подруга пригласила в экзотическое путешествие со скидкой, но нужны были срочные деньги. Сайт cntbank, который я нашёл по совету на форуме, предложил отличный список всех займов. Теперь я жду отпуск с нетерпением. Информация о сайте cntbank.ru Адрес: 125362, Россия, Москва, Подмосковная ул. 12А. Ссылка: актуальные займы

Byzaimov

Иногда жизнь ставит перед нами финансовые препятствия, которые нужно преодолеть как можно быстрее. В таких случаях каждая минута на вес золота. Именно поэтому мы предлагаем вам взять онлайн займ на карту. Наши преимущества: Минимальная ставка по займу. Мгновенное зачисление средств после одобрения. Гибкий график платежей, который можно подстроить под свои нужды. Круглосуточная поддержка клиентов. Мы заботимся о вашем времени и комфорте, предлагая лучшие условия для получения займа. Не упустите эту возможность, воспользуйтесь нашим предложением прямо сейчас!

Zaim-online

Вы ищете доступные и выгодные варианты займов? Хотите узнать о всех новинках в мире микрофинансов? Тогда вам стоит обратить внимание на наши новые займы онлайн на карту. С нами вы всегда будете в курсе последних предложений и акций. Возможности, которые открываются с нашими новыми продуктами: Большие суммы займа. Привлекательные ставки. Скидки для постоянных клиентов. Программы лояльности с бонусами и подарками. Не упустите возможность стать одним из первых, кто воспользуется нашими уникальными предложениями!

Zaim-online

Столкнулись с финансовыми трудностями и не знаете, как быстро и без лишних проблем решить эту ситуацию? Не хотите ждать долгого одобрения от банка или идти через множество проверок? Тогда мы идем к вам на помощь! С нашим сервисом вы сможете получить займ на карту срочно без отказа в кратчайшие сроки. Почему это выгодно: Получение денег в течение 15 минут после одобрения. Абсолютно никаких проверок и отказов. Возможность выбора удобных для вас сроков возврата займа. Прозрачные условия, без скрытых комиссий и штрафов. Более того, наша система работает круглосуточно, поэтому вы можете решить свои финансовые проблемы в любое время суток. Не упустите эту возможность, воспользуйтесь нашим предложением уже сегодня!

Zaim-online

Столкнулись с неотложными финансовыми проблемами и нужны деньги прямо сейчас? Нет времени ждать одобрения от банка? У нас есть решение! Получите займ на карту срочно без отказа и закройте все свои текущие финансовые потребности. С нашей помощью вы сможете: Получить деньги в течение 15 минут. Не переживать о проверках и отказах. Вернуть займ в удобные для вас сроки. Не теряйте времени на поиски других вариантов, когда у вас есть быстрый и надежный способ получить необходимую сумму.

вывоз мусора коробицыно

Вывоз мусора — неотъемлемая часть любых строительных или ремонтных работ. И один из ключевых вопросов, который волнует каждого — это стоимость услуги. В Санкт-Петербурге цены могут значительно варьироваться в зависимости от объема и типа мусора. Если вы хотите знать, сколько именно это будет стоить в вашем случае, рекомендую посетить сайт сколько стоит вывоз мусора в спб. Там вы найдете подробную информацию и сможете рассчитать бюджет.

пухто для вывоза мусора спб

Проблема вывоза мусора актуальна не только для жителей больших городов, но и для тех, кто живет в пригороде. В ленобласти, и особенно в гатчинском районе, есть несколько компаний, предлагающих соответствующие услуги. Если вы живете в этом районе и вам нужен вывоз мусора, посетите сайт вывоз мусора в ленобласти гатчинский район. Здесь вы найдете всю необходимую информацию, сможете сравнить цены и выбрать наиболее подходящий для вас вариант.

вывоз мусора коробицыно

Вывоз мусора — задача, с которой сталкиваются многие, особенно после ремонта или большой уборки. Чтобы не сталкиваться с проблемами утилизации, лучше обратиться к профессионалам. На сайте вывоз мусора предлагается широкий спектр услуг, включая вывоз строительного, бытового и опасного мусора. Компания работает быстро и качественно, что позволяет клиентам сэкономить время и нервы.

турецкие сериалы онлайн на русском языке

Пропустили последний сезон вашего любимого турецкого шоу? Нет проблем! На нашем сайте вы можете смотреть турецкие сериалы на русском языке онлайн, где и когда угодно. Доступно с любого устройства, без подписки и скрытых платежей. Подключитесь к огромной аудитории поклонников и делитесь впечатлениями!

новые турецкие сериалы онлайн

Ах, мир турецких сериалов, полный чувств, эмоций и неожиданных перипетий. Здесь, на нашем сайте, каждый клик мышью — это как перелистывание страницы увлекательной книги. С турецкими сериалами онлайн, каждый ваш вечер превратится в настоящий кинематографический фестиваль. Позвольте себе окунуться в это искусство без ограничений и рамок.

гостиница с отчетными документами

Nice post. I learn something new and challenging on sites I stumbleupon every day. It will always be interesting to read content from other writers and practice a little something from their sites.

InfoCredit-24

Каждый месяц я оплачиваю аренду квартиры, и в этот раз деньги на счету закончились раньше времени. Не зная, что делать, я нашла сайт credit-info24.ru. Этот портал собрал все МФО в одном месте и предложил деньги до зарплаты на карту без отказа. Спасибо этому сервису, я смогла оплатить аренду в срок и избежать неприятных моментов с арендодателем.

InfoCredit-24

Скоро день рождения моей жены, и я хочу сделать ей неожиданный и запоминающийся подарок. Проблема в том, что до зарплаты ещё две недели. Сайт credit-info24.ru, где собраны все МФО, предлагает срочно взять займ на карту без отказа. Я решил воспользоваться этой возможностью, и всё прошло гладко. Теперь у меня есть средства для подарка, и я уверен, что жена будет в восторге.

InfoCredit

На работе произошла непредвиденная ситуация, и мне срочно понадобились деньги для закупки оборудования. Банки отказывали или предлагали не выгодные условия. В этот момент я узнал про сайт быстрый займ на карту срочно. Здесь я получил необходимую сумму в кратчайшие сроки и смог решить все проблемы на работе. Сейчас всё стабильно, и я даже получил премию за решение сложной ситуации.

новые займы на карту

Как-то раз перед отпуском я понял, что денег не хватает даже на самые необходимые вещи. Паника начала охватывать меня, ведь отменять поездку было уже поздно. И тут я наткнулся на сайт топ займов без отказа. Решил попробовать, и оказалось, что это именно то, что мне нужно! Процесс занял всего несколько минут, и деньги уже были на карте. Таким образом, отпуск удался на славу, и даже не пришлось чем-то жертвовать.

новые сериалы в хорошем качестве

Моя девушка и я решили провести вечер вдвоём. Мы оба являемся поклонниками хорошего кино, и поэтому выбор пал на hdserialclub.net. Здесь есть лучшие сериалы на русском языке, что для нас было очень важно. Мы выбрали один из романтических сериалов и провели прекрасный вечер, полный эмоций и хорошего настроения.

займ на банковскую карту

Каждый месяц я оплачиваю аренду квартиры, и в этот раз деньги на счету закончились раньше времени. Не зная, что делать, я нашла сайт credit-info24.ru. Этот портал собрал все МФО в одном месте и предложил деньги до зарплаты на карту без отказа. Спасибо этому сервису, я смогла оплатить аренду в срок и избежать неприятных моментов с арендодателем.

glavdachnik.ru

Wow, amazing blog layout! How long have you been blogging for? you make blogging glance easy. The full glance of your web site is wonderful, let alonesmartly as the content!

сериалы комедии онлайн

Вы знаете, как бывает: интересный сериал, но озвучка или субтитры оставляют желать лучшего. Именно поэтому я выбираю hdserialclub.net. Здесь вы найдете новые сериалы на русском языке, что делает просмотр настолько удобным, насколько это возможно. Никаких искажений смысла, только чистый и ясный перевод. И это не просто новинки, это лучшее из мира кино и телевидения, доступное в пару кликов.

Заказать SEO продвижение

Hey there just wanted to give you a quick heads up. The text in your post seem to be running off the screen in Safari. I'm not sure if this is a format issue or something to do with internet browser compatibility but I thought I'd post to let you know. The style and design look great though! Hope you get the problem solved soon. Kudos

Vavada accub

Казино Vavada предлагает огромный набор игровых автоматов и возможность выиграть большие деньги. Чтобы начать играть, необходимо [url=https://play-casino-vavada.online/]зарегистрироваться в Вавада[/url]. [url=https://play-casino-vavada.online/]Регистрация в Вавада[/url] очень простая и быстрая.. Вам потребуется заполнить небольшую форму, указав свои личные данные, такие как имя, фамилия, электронная почта и номер телефона. Пожалуйста, убедитесь, что вводите правильные данные, чтобы избежать проблем при выводе выигрышей. После заполнения формы вам будет предложено создать уникальное имя пользователя и пароль для входа в ваш аккаунт. Используйте только надежные пароли во избежание потери аккаунта. После завершения регистрации просто подтвердите свой аккаунт, перейдя по ссылке, которая придет вам на почту. После подтверждения авторизоваться и сразу начать играть Vavada. Не забудьте ознакомиться с правилами и условиями казино, чтобы быть в курсе всех требований и ограничений. Следите за рисками при игре, не проигрывайте больше, чем готовы проиграть. Удачи в [url=https://play-casino-vavada.online/]вавада[/url]! Наслаждайтесь азартом и возможностью выиграть большие призы!

Мостбет

В эпоху цифровых технологий операции с финансами должны быть максимально простыми и безопасными. Ввод денег в Мостбет Узбекистан отвечает всем современным требованиям: высокая скорость транзакций, надежность сохранения средств и прозрачность финансовых операций. Клиенты Мостбет могут быть уверены в том, что их средства поступают на счет мгновенно, а широкий выбор платежных систем делает процесс ввода и вывода средств удобным для каждого пользователя. Это не только повышает доверие игроков, но и способствует росту популярности букмекерской платформы в регионе.

Мостбет регистрация в Белорусии

Пустыни и горы Казахстана скрывают в себе не только богатства недр, но и невероятный мир азартных развлечений. Мостбет ставки в Казахстане – это целый оазис для тех, кто жаждет адреналина и крупных выигрышей. Здесь каждый найдет что-то по душе: от футбола до хоккея, от тенниса до баскетбола. Платформа Мостбет предлагает не только широкий выбор событий, но и выгодные коэффициенты, которые делают процесс ставок еще более привлекательным. С удобным интерфейсом и круглосуточной поддержкой клиентов, каждый шаг пользователя будет максимально комфортным. Будьте уверены, ваши ставки в безопасности, а выигрыши ждут своих героев.

Мостбет ставки в Украине

Киргизия — страна с богатыми традициями, где спорт занимает особое место в сердцах людей. Именно здесь, на пересечении востока и запада, Мостбет ставки в Киргизии предлагают каждому желающему окунуться в мир большого спорта. Вы не просто наблюдаете за игрой, вы становитесь её частью, делая ставки на любимые команды и спортсменов. Это не только способ поддержать своих идолов, но и возможность превратить свои прогнозы в реальный выигрыш. Мостбет обеспечивает полную безопасность и комфорт, открывая двери в мир ставок для начинающих и профессионалов.

Заказать SEO продвижение

Hello there! Do you know if they make any plugins to help with SEO? I'm trying to get my blog to rank for some targeted keywords but I'm not seeing very good results. If you know of any please share. Thanks!

цветной лом гост 1639 2009

I like the valuable information you supply for your articles. I will bookmark your weblog and test again here frequently. I am slightly certain I will be told plenty of new stuff right here! Good luck for the following!

RelzaimEvard

В эпоху цифровых технологий финансовые услуги становятся все более доступными. Одной из таких услуг является займ на любую карту. Теперь не важно, в каком банке у вас открыт счет, вы можете получить необходимую сумму прямо на вашу карту. Это удобно, быстро и, что немаловажно, безопасно. Многие МФО предлагают прозрачные условия и гибкую систему возврата средств, что делает этот продукт еще более привлекательным для потребителей.

bitokvesnuhin

Сдайте все трудности процесса оштукатуривание стен профессионалам на mehanizirovannaya-shtukaturka-moscow.ru. Вы в хороших руках.

RelzaimEvard

Когда срочно нужны деньги, каждая минута на счету. Но куда обратиться, если банки требуют массу документов и времени на проверку? Ответ прост – воспользуйтесь услугой быстрый займ на карту. Вам не придется ждать или объяснять, зачем вам средства. Просто заполните заявку онлайн, и в течение 15 минут деньги будут у вас на карте. Это удобно, это быстро, и что самое главное – это доступно в любое время дня и ночи. Позвольте себе дышать свободнее уже сегодня с нашими быстрыми займами.

NcThmfXsQblR

VmwqfUBO

SitiStroy

Новый интерьер от «СК Сити Строй": где мечты становятся реальностью Ваш дом — это ваша крепость, и ООО «СК СИТИ СТРОЙ» знает, как сделать его не только красивым, но и функциональным. С нашими ремонтными услугами каждый уголок вашего жилища будет продуман до мелочей. Мы ценим доверие наших клиентов и стремимся превзойти их ожидания, предлагая лучшие решения для жизни и отдыха. Наши специалисты учтут все, от общей концепции дизайна до выбора отделочных материалов. Превратить квартиру в дом мечты — это искусство, которому мы отдали многие годы, и мы готовы поделиться этим искусством с вами. Заходите на remont-siti.ru и узнайте, как мы можем помочь вам в создании идеального дома. Мы ждем вас по адресу: г. Москва, ул. Новослободская, д. 20, к. 27, оф. 6, чтобы начать этот творческий путь вместе.

TimothyEdips

Преобразите свое пространство с профессионалами «СК Сити Строй" Превратите свою московскую квартиру в место мечты с ООО «СК СИТИ СТРОЙ». Наша команда специалистов предлагает комплексный подход к ремонту квартир в столице, сочетая в себе качество, скорость и индивидуальный подход к каждому клиенту. Уже более 20 лет мы работаем в Москве и Подмосковье, реализуя проекты любой сложности и стилистики. Воспользовавшись услугой ремонт квартир в Москве, вы получаете гарантию качественного исполнения всех этапов работы. От дизайн-проекта до финальной отделки, наша команда обеспечит вас полным спектром услуг, включая современные технологии строительства и эксклюзивные материалы. Заходите на наш сайт и начните свой проект ремонта с ООО «СК СИТИ СТРОЙ». Мы расположены по адресу: 127055 г. Москва, ул. Новослободская, д. 20, к. 27, оф. 6, и готовы предложить вам лучший сервис. Позвольте нам сделать вашу квартиру не только уютной, но и функциональной, отражающей ваш индивидуальный стиль и предпочтения.

Vavadon

Регистрация в казино Vavada - это очень простой способ выиграть большие деньги в мире азартных игр. Вот нужные факты, которые следует узнать о регистрации в казино Вавада. Для начала, перейдите на официальный сайт казино Вавада. Сайт доступен всем: [url=https://vavada-reg1.online/]вавада игровые аппараты[/url]. Нажмите на кнопку «Регистрация», чтобы начать создавать свой аккаунт. Затем вам потребуется заполнить небольшую форму с основными данными, такими как имя, фамилия, электронная почта и пароль. Перед отправкой формы проверьте все введенные данные. После заполнения формы вам может потребоваться подтверждение электронной почты. Для этого перейдите по ссылке в письме, которое пришло к вам на почту. После подтверждения войдите в свой аккаунт, используя указанный логин и пароль. Перед вами откроется весь набор азартных игр казино Вавада. Казино Вавада также предлагает различные бонусы и акции для новых игроков. При первом входе вы можете получить фриспины на слотах или дополнительный бонусный кредит, который позволит вам играть бесплатно. Помните, что регистрация в казино Vavada доступна только для лиц, достигших совершеннолетия и соответствующих требованиям законодательства вашей страны. Казино Вавада также гарантирует сохранность ваших личных данных.

maps-edu.ru

Внимание, врачи! Вы ищете надежного партнера для прохождения аккредитации без лишних хлопот? Мы предлагаем вам услугу [url=https://maps-edu.ru/akkreditaciya-medrabotnikov]аккредитация врачей под ключ[/url] — ваш личный путь к успеху в медицинской карьере! Наш центр предоставляет полный спектр услуг для подготовки и сдачи аккредитационного экзамена. Вам не придется беспокоиться о бумажной работе и подготовке — мы возьмем все эти заботы на себя. Обратившись к нам, вы получите доступ к современным учебным материалам, индивидуальные консультации с экспертами и комплексную поддержку на всех этапах аккредитации. Не упустите шанс сделать свой путь в профессии более простым и эффективным! Также советуем вам обратить внимание на [url=https://maps-edu.ru/akkreditaciya-medrabotnikov]периодическая аккредитация медработников[/url] и ознакомиться с этим по лучше. У нас на сайте maps-edu вы можете задать вопросы и получить консультацию. Адрес: Иркутск, ул. Степана Разина, дом 6, офис 405.

турецкие сериалы в хорошем hd 720 качестве

Турецкие комедийные сериалы — это отличный способ поднять настроение и отдохнуть после напряженного дня. Они полны искрометного юмора, живых персонажей и ситуаций, в которых каждый может узнать себя. Если вы в поиске легкого и веселого просмотра, обратите внимание на сайт, где можно найти турецкие сериалы комедии для бесплатного просмотра. Что делает турецкие комедии такими особенными? Возможно, дело в уникальном сочетании восточных традиций и современных тенденций, которые отражаются в каждой серии. Такие сериалы как «Любовь не понимает слов» или «Постучись в мою дверь» уже завоевали сердца русскоязычных зрителей.

Salvador

Hi, the whole thing is going well here and ofcourse every one is sharing information, that's genuinely fine, keep up writing.

maps-edu.ru

Ваша карьера в медицине не должна стоять на месте. Откройте двери к новым возможностям с дистанционным повышением квалификации! В эру цифровых технологий возможности для профессионального роста стали ещё более доступными. Наша программа [url=https://maps-edu.ru/obuchenie-vrachey]повышение квалификации медицинских работников дистанционное обучение[/url] предлагает гибкий и удобный способ обновить ваши знания и улучшить навыки, не выходя из дома. Независимо от того, где вы находитесь, вы сможете получить доступ к курсам, проводимым ведущими экспертами в области медицины. Поднимите свой профессиональный уровень, развивайте специализацию или осваивайте новые области медицинской науки, уделяя всего несколько часов в неделю обучению. Мы предлагаем современные образовательные материалы, интерактивные сессии и полную поддержку на пути к вашему успеху. Также советуем вам обратить внимание на [url=https://maps-edu.ru/akkreditaciya-medrabotnikov]аккредитация средних медработников[/url] и ознакомиться с этим по лучше. У нас на сайте maps-edu вы можете задать вопросы и получить консультацию. Адрес: Иркутск, ул. Степана Разина, дом 6, офис 405.

турецкие сериалы новинки

Индийское кино — это целая вселенная, полная красок, музыки и танцев. Оно дарит зрителям не только эстетическое наслаждение, но и уроки жизни, любви, дружбы и справедливости. Сегодня для любителей болливудских шедевров открыты множество возможностей, и одна из них — это смотреть индийские фильмы на русском языке онлайн. Болливуд неустанно радует нас новинками, каждая из которых уникальна по-своему. Ведь индийские фильмы — это не просто развлекательные истории, это произведения искусства, которые затрагивают самые глубокие струны души. Будь то захватывающие исторические эпопеи, романтические мелодрамы или жизнерадостные комедии — каждый найдет что-то для себя. Особое внимание стоит уделить музыкальным номерам, которые являются неотъемлемой частью индийского кинематографа. Эти танцевальные сцены не просто дополняют сюжет, но и помогают глубже понять культуру и традиции Индии. Кроме того, благодаря доступности фильмов на русском языке, вы сможете полностью погрузиться в атмосферу Болливуда, не отвлекаясь на чтение субтитров. Интернет-платформы предлагают удобный поиск и широкий выбор фильмов, позволяя вам наслаждаться индийским кино в любое время и в любом месте. Так что если вы ищете источник вдохновения или просто хотите провести время за просмотром качественного кино, то индийские фильмы на русском языке — ваш идеальный выбор.

their explanation

After looking at a few of the articles on your blog, I really like your technique of blogging. I book-marked it to my bookmark website list and will be checking back soon. Please visit my website as well and let me know your opinion.

wiki-cafe.win

What a data of un-ambiguity and preserveness of valuable experience about unexpected feelings.

Geraldo

It's an remarkable post in favor of all the web people; they will take benefit from it I am sure.

Furfurfriend

Elevate your style with our sophisticated selection. Gentlemen can buy mens watch designs that exude elegance and prowess from our online store.

курсы повышения квалификации средних медицинских работников

Ваша карьера в медицине не должна стоять на месте. Откройте двери к новым возможностям с дистанционным повышением квалификации! В эру цифровых технологий возможности для профессионального роста стали ещё более доступными. Наша программа [url=https://maps-edu.ru/obuchenie-vrachey]повышение квалификации медицинских работников дистанционное обучение[/url] предлагает гибкий и удобный способ обновить ваши знания и улучшить навыки, не выходя из дома. Независимо от того, где вы находитесь, вы сможете получить доступ к курсам, проводимым ведущими экспертами в области медицины. Поднимите свой профессиональный уровень, развивайте специализацию или осваивайте новые области медицинской науки, уделяя всего несколько часов в неделю обучению. Мы предлагаем современные образовательные материалы, интерактивные сессии и полную поддержку на пути к вашему успеху. Также советуем вам обратить внимание на [url=https://maps-edu.ru/akkreditaciya-nemedicinskogo-personala]аккредитация специалистов с высшим немедицинским образованием[/url] и ознакомиться с этим по лучше. У нас на сайте maps-edu вы можете задать вопросы и получить консультацию. Адрес: Иркутск, ул. Степана Разина, дом 6, офис 405.

институт повышения квалификации медработников

В современном мире требования к медицинским работникам постоянно растут, и на первый план выходит вопрос их качественного обучения. Образовательные учреждения по всему миру разрабатывают и внедряют новые методики и программы, чтобы обучение медработников соответствовало последним научным достижениям и практическим потребностям здравоохранения. Согласно исследованиям, комплексный подход к образованию, включающий как традиционные лекции, так и современные интерактивные технологии, значительно повышает качество обучения и укрепляет практические навыки. [url=https://maps-edu.ru/obuchenie-vrachey]Обучение медработников[/url], оснащенное виртуальными лабораториями, симуляторами реальных клинических ситуаций и системами оценки компетенций, становится залогом подготовки высококвалифицированных специалистов, способных эффективно реагировать на вызовы современной медицины. Также советуем вам обратить внимание на [url=https://maps-edu.ru/akkreditaciya-medrabotnikov]стоимость аккредитации медработников[/url] и ознакомиться с этим по лучше. У нас на сайте maps-edu вы можете задать вопросы и получить консультацию. Адрес: Иркутск, ул. Степана Разина, дом 6, офис 405.

Mapsedanag

Стремитесь к совершенству в медицинской карьере с maps-edu.ru. Выбирайте из множества курсов для повышения квалификации и профессионального роста.

Furfurfriend

Shopping for timepieces has never been easier. Buy watches online with us and experience hassle-free shopping and exceptional customer service.

Mapsedanag

Maps-edu.ru открывает двери в мир медицинского образования. Наши курсы помогут вам оставаться в курсе последних трендов и технологий в медицине. Зарегистрируйтесь сегодня!

краска для ткани

Nice blog here! Also your website rather a lot up fast! What host are you using? Can I am getting your associate link on your host? I desire my website loaded up as fast as yours lol

autocad

I was wondering if you ever considered changing the layout of your site? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or two images. Maybe you could space it out better?

DavidDus

поисковая реклама - важный шаг для любого бизнеса, стремящегося к повышению видимости в интернете. Это долгосрочная инвестиция, которая окупится за счет увеличения трафика на сайт и роста продаж. Важно выбирать надежного исполнителя, который использует только "белые" методы продвижения.

продвижение сайта в поисковых системах цена

сео продвижение сайта цена - эффективный способ привлечения целевой аудитории на ваш сайт. Это реклама, которая показывается пользователям, заинтересованным в вашем продукте или услуге. Правильно настроенная контекстная реклама позволит вам быстро увеличить количество посетителей и улучшить конверсию.

https://crazysale.marketing/

Hi there, after reading this awesome post i am also happy to share my familiarity here with mates.

лечение наркозависимый телефон

I think this is one of the so much important information for me. And i'm satisfied reading your article. However want to remark on few general things, The site taste is perfect, the articles is really excellent : D. Just right process, cheers

Займы онлайн